From a Stanford Medicine online release:

“For patients with severe but stable heart disease who don’t want to undergo these invasive procedures, these results are very reassuring,” said David Maron, MD, clinical professor of medicine and director of preventive cardiology at the Stanford School of Medicine, and co-chair of the trial, called ISCHEMIA, for International Study of Comparative Health Effectiveness with Medical and Invasive Approaches.

“For patients with severe but stable heart disease who don’t want to undergo these invasive procedures, these results are very reassuring,” said David Maron, MD, clinical professor of medicine and director of preventive cardiology at the Stanford School of Medicine, and co-chair of the trial, called ISCHEMIA, for International Study of Comparative Health Effectiveness with Medical and Invasive Approaches.

“The results don’t suggest they should undergo procedures in order to prevent cardiac events,” added Maron, who is also chief of the Stanford Prevention Research Center.

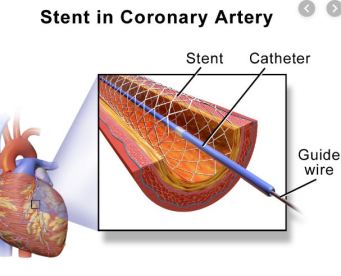

Patients with severe but stable heart disease who are treated with medications and lifestyle advice alone are no more at risk of a heart attack or death than those who undergo invasive surgical procedures, according to a large, federally-funded clinical trial led by researchers at the Stanford School of Medicine and New York University’s medical school.

The trial did show, however, that among patients with coronary artery disease who also had symptoms of angina — chest pain caused by restricted blood flow to the heart — treatment with invasive procedures, such as stents or bypass surgery, was more effective at relieving symptoms and improving quality of life.

To read more: http://med.stanford.edu/news/all-news/2019/11/invasive-heart-treatments-not-always-needed.html

In 1965, James Baldwin, by then internationally famous, faced off against William F. Buckley Jr., one of the leading voices of American conservatism, in a debate hosted by the Cambridge Union in England. The debate proposition before the house was: “The American dream is at the expense of the American Negro.”

In 1965, James Baldwin, by then internationally famous, faced off against William F. Buckley Jr., one of the leading voices of American conservatism, in a debate hosted by the Cambridge Union in England. The debate proposition before the house was: “The American dream is at the expense of the American Negro.”

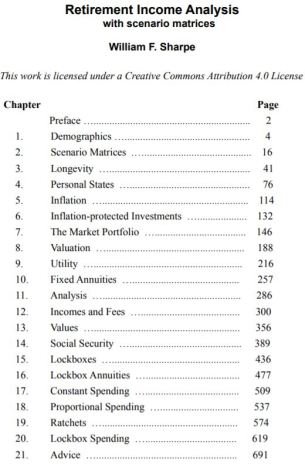

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision. Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Syndicated columnist Mark Shields and New York Times columnist David Brooks join Judy Woodruff to discuss the week in politics, including whether public impeachment hearings are making President Trump more or less vulnerable, what stood out about the witnesses who testified so far, whether Trump’s Ukraine dealings are surprising or “in character” and the latest dynamics among 2020 Democrats.

Syndicated columnist Mark Shields and New York Times columnist David Brooks join Judy Woodruff to discuss the week in politics, including whether public impeachment hearings are making President Trump more or less vulnerable, what stood out about the witnesses who testified so far, whether Trump’s Ukraine dealings are surprising or “in character” and the latest dynamics among 2020 Democrats.

Wi-Charge says it has a solution to the problem. Its technology allows users to power small devices, such as smartphones, smart fire alarms, and smart locks, from several feet away without any wires.

Wi-Charge says it has a solution to the problem. Its technology allows users to power small devices, such as smartphones, smart fire alarms, and smart locks, from several feet away without any wires.