BARRON’S MAGAZINE – SEPTEMBER 22, 2023: The latest issue features the $50 Billion question – How Ozempic and Wegovy could break the healthcare system.

How Ozempic and Wegovy Could Break the Healthcare System

Between cost and demand, the latest breed of weight-loss drugs could transform healthcare in the U.S.—for good and ill.

How a Government Shutdown Could Hurt Retirees

Social Security checks will keep coming, but expect other complications.

China Is in Trouble, but It’s Not as Bad as Some Think

Those ready to write off the country underestimate the resources of policy makers and the power of an $18 trillion economy that is home to 1.4 billion people.Long read

This Busted Bank Merger Is Fixing Itself. Its Stock Is Worth Buying.

Four years after it was created, Truist Financial is finally dealing with the issues that have damaged it. The case for investing now.Long read

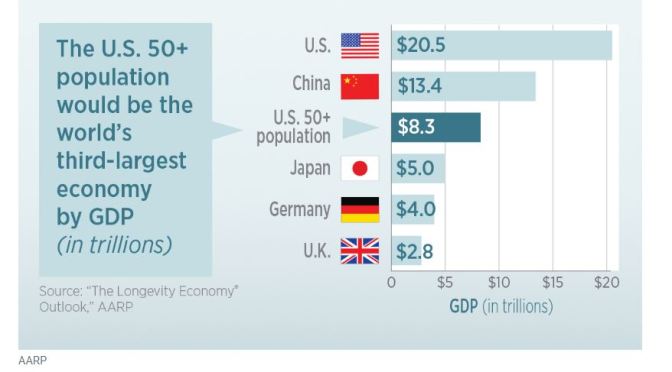

• For many devices, adoption among adults ages 50 and older is comparable to younger generations. Adults ages 50

• For many devices, adoption among adults ages 50 and older is comparable to younger generations. Adults ages 50

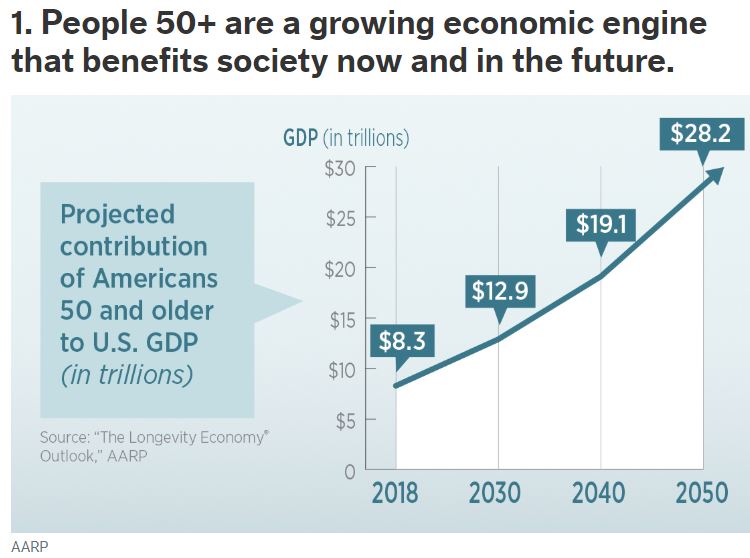

“As the number of people over 50 grows, that age cohort is transforming markets and sparking new ideas, products and services across our economy,” AARP CEO Jo Ann Jenkins says. “And as people extend their work lives, they are fueling economic growth past the traditional retirement age.

“As the number of people over 50 grows, that age cohort is transforming markets and sparking new ideas, products and services across our economy,” AARP CEO Jo Ann Jenkins says. “And as people extend their work lives, they are fueling economic growth past the traditional retirement age.

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.