In 2020, golf saw a surge in new players following the Covid-19 pandemic and social distancing measures. Callaway, the maker of golf balls, clubs, bags and apparel, has been thriving. But with movie theaters, travel and concerts expected to rebound, will golf club makers like Callaway and its rival Acushnet be able to maintain their momentum?

Tag Archives: CNBC Videos

Analysis: How Will Fossil Watches Survive? (Video)

The global watchmaking industry has changed since the introduction of the smartphone and as demand for fitness trackers and smartwatches grow. Legacy watchmakers, like Fossil, have had to adapt and give customers new reasons to keep timepieces on their wrists. The company has been planning for the future by bringing its own smartwatches to market, initiating a multi-year turnaround plan and focusing on growing markets in China and India. But will that be enough?

Analysis: Can EV Battery Swapping Gain In The U.S.?

San Francisco-based Ample has brought electric vehicle battery swapping to the U.S. The company was in stealth mode for seven years before launching recently with five swapping stations in the Bay Area. Uber drivers in the area are Ample’s first customers.

The concept isn’t new. A start-up called Better Place launched an EV and battery swapping company after it raised $850 million in venture funding, but it ultimately went bankrupt in 2013. Tesla also demoed battery swapping in 2013 but only opened one station for about a year. Elon Musk said Tesla owners were not interested in it.

Battery swapping is already common in China. Electric vehicle maker Nio, for example, plans to double its network of swapping stations to 500 this year and plans to open stations in Norway as part of its expansion into Europe. Ample has a different approach, with modular batteries and a focus on fleets. CNBC got an inside look at its headquarters and battery factory in San Francisco to learn how the company plans to bring battery swapping into the mainstream.

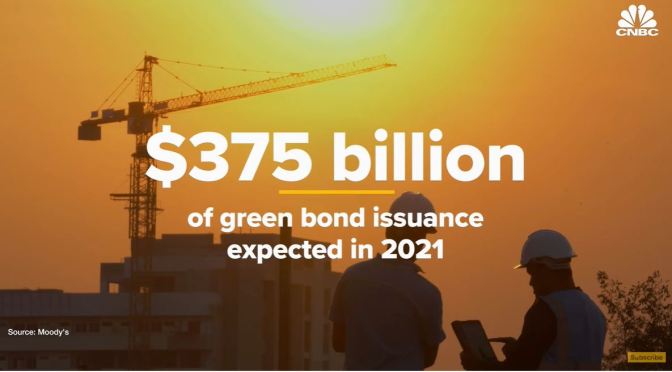

Finance: The $1 Trillion Market For ‘Green Bonds’

So-called green bonds have become more popular in recent years, and this fast-growing segment of the $128.3 trillion global bond market could grow even more. When an issuer sells a green bond, they’re making a nonbinding commitment to earmark the sale’s proceeds for environmentally friendly projects. That could include renewable energy projects, constructing energy efficient buildings or making investments in clean water or transportation. Green bonds fall under the wider umbrella of sustainable bonds, which include fixed-income instruments whose proceeds are set aside for social or sustainability projects. Big household names such as Apple and PepsiCo are diving into this space. A handful of massive banks and governments around the world are also issuing sustainable bonds, including China, Russia and the European Union. This may be contributing to the space’s rapid growth. A report from Moody’s said new sustainable bond issuance may top $650 billion in 2021. That would represent a 32% jump from 2020.

Analysis: Why U.S. Houses Are So Expensive (CNBC)

With Covid encouraging city-dwellers to emigrate to the suburbs and families looking for home offices and bigger yards, prices for the American dream home have skyrocketed. Home prices surged in March 2021 up 13% from the year prior, according to the S&P Case-Shiller index. With homeowners unwilling to sell, a record-low supply of homes for sale has forced buyers into intense bidding wars. At the end of April 2021 there were only 1.16 million houses for sale in the U.S. down more than 20.5% from the year prior. Higher costs for land, labor and building materials including lumber have also impacted homebuilders. With the 30-year fixed mortgage rate hovering near a 50-year low and strong demand pushing prices to all-time highs, why is the housing supply so meager? Watch the video to find out if the U.S. is running out of houses.

Analysis: How Coca-Cola Leads Beverage Market

With more than 1.9 billion drinks served every day Coca-Cola is one of the world’s largest beverage companies. From its humble beginnings selling a single product at a drugstore for 5 cents a glass, the company now has a roster of 200 brands that includes Coke, Fanta, and Sprite. But with health and wellness trends on the rise, the company has been forced to pivot. So after 135-years in business, can the soft drink giant stay on top? And what will the secular decline of sugar-sweetened beverages in the U.S. mean for the future of Coca-Cola?

Air Travel: The Rise Of Pilotless Planes (Video)

Over the past 100 years, the technology inside airplanes has become more and more advanced from jumbo jets to smaller Cessna’s. Some see the next step to full automation as removing the pilot completely. Reliable Robots and Xwing are two Bay Area start-ups working on doing just that. Rather than build new aircraft, both companies have retrofitted Cessna Grand Caravan’s. The planes can fly autonomously with a remote operator who monitors the flight and can take control if needed. Both companies are working with the FAA on getting approval. Xwing took CNBC for a test flight, where the pilot didn’t touch the controls once. Watch the video to learn how it works and when pilotless planes will become the norm.

Business: Why Arizona is Now A Technology Hub

Arizona has rapidly become an epicenter for electric vehicle and self-driving tech, and it’s now the site of three big new semiconductor factories as the U.S. struggles to increase production during the global chip shortage. In 2020, Phoenix attracted more residents than any other U.S. city for the fourth year in a row, as highly skilled workers flocked to the lower cost of living and wide open spaces of the Grand Canyon State. From Lucid Motors to ElectraMeccanica, Intel to Taiwan Semiconductor Manufacturing Co, 634 companies relocated or expanded in Arizona between 2015 and 2020. CNBC asked the governor, big companies, and Arizonans about why the tech boom is happening and how it’s changing the state.

Analysis: Why The World Is Running Out Of Sand

Even though sand can be found in nearly every single country on Earth, the world could soon face a shortage of this crucial, under-appreciated commodity. Sand use around the world has tripled in the last twenty years, according to the UNEP. That’s far greater than the rate at which sand is being replenished. Here’s what’s behind the looming sand crisis.

Analysis: The Microchip Shortage Limiting Autos

While the automotive industry was ravaged early on in the pandemic thanks to lockdown measures and a dramatic decrease in travel, it more recently has begun facing a new problem: a shortage of microchips.

Microchips are vital to much of a vehicle’s key functions, such as engine control, transmission, infotainment systems, and more. In the last half of 2020 and now in 2021, vehicle sales recovered fairly quickly, faster than automakers anticipated.

Suddenly, they were struggling to meet demand. At the same time, chipmakers were experiencing supply shortages and increased demand from other sectors, such as personal electronics. With the resulting lack of microchip supply, automakers have been forced to slow production, even on their most popular models. For several automakers, the shortage is expected to cost them $1 billion or more — and even still, the alternatives are worryingly few.