Infographic: Americans Feel ‘Old’ At 47, Fear Aging And Cognitive Decline

If you’re enrolled only in original Medicare with a Medigap supplemental plan, and don’t use a drug plan, there’s no need to re-evaluate your coverage, experts say. But Part D drug plans should be reviewed annually. The same applies to Advantage plans, which often wrap in prescription coverage and can make changes to their rosters of in-network health care providers.

“The amount of information that consumers need to grasp is dizzying, and it turns them off from doing a search,” Mr. Riccardi said. “They feel paralyzed about making a choice, and some just don’t think there is a more affordable plan out there for them.”

When creation of the prescription drug benefit was being debated, progressive Medicare advocates fought to expand the existing program to include drug coverage, funded by a standard premium, similar to the structure of Part B. The standard Part B premium this year is $144.60; the only exceptions to that are high-income enrollees, who pay special income-related surcharges, and very low-income enrollees, who are eligible for special subsidies to help them meet Medicare costs.

“Given the enormous Medicare population that could be negotiated for, I think most drugs could be offered through a standard Medicare plan,” said Judith A. Stein, executive director of the Center for Medicare Advocacy.

“Instead, we have this very fragmented system that assumes very savvy, active consumers will somehow shop among dozens of plan options to see what drugs are available and at what cost with all the myriad co-pays and cost-sharing options,” she added.

Advocates like Ms. Stein also urged controlling program costs by allowing Medicare to negotiate drug prices with pharmaceutical companies — something the legislation that created Part D forbids.

The outcome of the 2020 election between Joe Biden and Donald Trump will likely have a major impact on the equity market. Although the economy has historically performed better under a Democratic president, that doesn’t always necessarily reflect on market performance. However, which party controls the White House can still be an important element for those looking to earn big in the market. So how does the U.S. election impact the stock market and how should investors prepare?

The pandemic has spurred surges in camping and RV travel due to the need for social distancing and outdoor activity. But it’s not all fun and vacations: one group of Americans adopted a self-sufficient and nomadic lifestyle long ago, living full-time in motor homes and working seasonal jobs to support themselves as they travel the United States. Paul Solman reports on retirement-age “workampers.”

From a The Real Deal online article:

A unit at the Clare costs an average one-time entrance fee of $800,000 or so, along with around $5,500 monthly fees. The entrance fee is refunded when a resident dies or moves out. Entrance fees at a typical senior living facility is around $369,000.

The 53-story Clare tower on Chicago’s Magnificent Mile has sold for $105 million, a sign that luxury senior living facilities hold huge upside in today’s market.

Fundamental Advisors LP sold the luxury seniors-only tower for twice what the private equity firm paid for the 334-unit tower in 2012, according to the Wall Street Journal.

Electric planes could soon fly commuters from city to city, a transport minister has disclosed. George Freeman, minister for transport and innovation, told The Telegraph’s “Chopper’s Brexit Podcast” that there was “a whole opportunity for short-haul transport at low altitude” that the country was yet to grasp.

In an episode of 2020 predictions, Mr Freeman said: “This will be the year where we begin to see a whole new world of low level aviation, Velocopters, electric planes. We already run the world’s first commercial electric plane service and Boris and I have been looking at how we can develop UK leadership in electric plane technology.” Mr Freeman said the planes could take eight passengers and fly at 2,500ft and could be used for “short hops between cities that take you an hour or two in the car, pumping out carbon monoxide.”

“At the moment the electric plane seats eight. But you know what the aerospace industry is like – eight soon becomes 18, and that soon becomes 28. We are determined to lead in the revolution of clean transport.”

To listen to the podcast in full, head here: https://www.telegraph.co.uk/politics/…

From a Wall Street Journal online article:

![]()

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.

It is the latest way for universities to profit from one of their greatest assets, land. Colleges have already taken advantage of this privilege by developing hotels and high-end student housing. Now, some see sales of upscale senior housing as the next step.

Lasell University, just west of Boston, built one of the first on-campus senior communities two decades ago. It requires members to take 450 hours of coursework or activities each year. Other programs have since sprouted up in places like the University of Michigan and Oberlin College in Ohio. Some communities are on campus; others are situated nearby and may have only a loose affiliation with the school. Many offer assisted living and nursing options.

To read more: https://www.wsj.com/articles/seniors-want-to-go-back-to-class-universities-want-to-sell-them-real-estate-11576751403

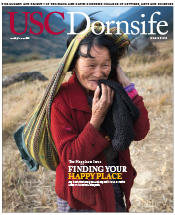

From a USC Dornsife Magazine article by Susan Bell:

Contrary to popular opinion, when it comes to well-being, our lives do not represent an inevitable decline from the sunny uplands of youth to the valley of death. Instead, the opposite is true — we can confidently look forward to old age as the happiest time of our lives.

Contrary to popular opinion, when it comes to well-being, our lives do not represent an inevitable decline from the sunny uplands of youth to the valley of death. Instead, the opposite is true — we can confidently look forward to old age as the happiest time of our lives.

More than 50 years have passed since The Who’s Pete Townshend penned these immortal lines on his 20th birthday, resulting in the band’s iconic ode to rebellious youth, “My Generation.” These days there is no hint that the rock star, now a spritely septuagenarian, is entertaining any regrets that his youthful wish didn’t come true.

So why do people grow happier as they age? Is it an absence of stress, or are they able to focus more on what brings them joy?

So why do people grow happier as they age? Is it an absence of stress, or are they able to focus more on what brings them joy?

But as a young man, Townshend certainly wasn’t alone in dreading old age, and while his suggested remedy for avoiding the unavoidable may have been extreme, he also wasn’t alone in wanting to dodge what we tend to believe will be the miseries of aging.

To read more: https://dornsife.usc.edu/news/stories/3117/happiness-across-the-life-span-not-a-slippery-slope-after-all/

Professional Canadian athlete Justin Kelly celebrates retirement by hitting the road on his motorcycle and enjoying the waves in Malibu. Share in Justin’s vision for sustaining his love for travel after retiring his #27 jersey and completing a remarkable ice hockey career.

Professional Canadian athlete Justin Kelly celebrates retirement by hitting the road on his motorcycle and enjoying the waves in Malibu. Share in Justin’s vision for sustaining his love for travel after retiring his #27 jersey and completing a remarkable ice hockey career.

https://www.justinkelly27.com/

Website: https://www.livingvehicle.com/