Tech ownership among older adults is growing with no signs of slowing down.

• For many devices, adoption among adults ages 50 and older is comparable to younger generations. Adults ages 50

• For many devices, adoption among adults ages 50 and older is comparable to younger generations. Adults ages 50

and older are adopting smartphones, wearables, home assistants/smart speakers, and smart home technology at

nearly the same rate as adults ages 18–49.

• Younger adults have abandoned tablets, but older adults are adopting tablets at an increasing rate: More than half

(52%) of adults ages 50 and older own a tablet.

• Once adopted, usage of smartphones, wearables, tablets, home assistants/smart speakers, and smart home

technology is high with most owners using their technology daily.

While older adults are highly engaged with their devices, many are not using the technology to its full potential.

• Adults ages 50 and older are using smartphones and tablets to maintain social connections, find information, and for

entertainment, but only a few are using their device to automate their home or conduct transactions.

• Engaging in social media is one of the most common uses of a tech device (e.g., computer, tablet, or smartphone).

• Though 49% claim to own a smart TV, only 42% are using streaming or online options to watch shows.

• Nearly half (46%) of all smart home assistant/smart speaker owners do not use their device daily.

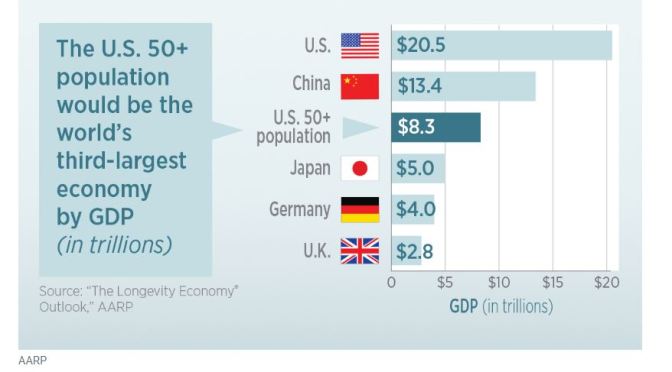

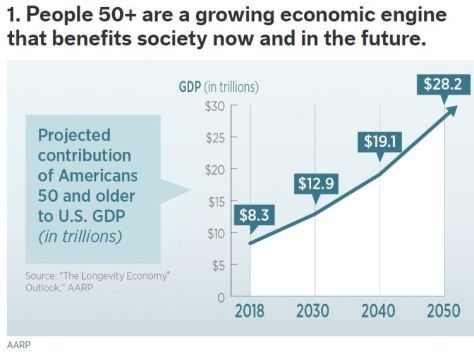

“As the number of people over 50 grows, that age cohort is transforming markets and sparking new ideas, products and services across our economy,” AARP CEO Jo Ann Jenkins says. “And as people extend their work lives, they are fueling economic growth past the traditional retirement age.

“As the number of people over 50 grows, that age cohort is transforming markets and sparking new ideas, products and services across our economy,” AARP CEO Jo Ann Jenkins says. “And as people extend their work lives, they are fueling economic growth past the traditional retirement age.

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.

More schools are building or planning senior-living facilities on or near campus to cater to baby boomers who view college as a stimulating alternative to bingo at an archetypal retirement home. Some savor the pursuit of academic and cultural interests. Others are lured by the promise of interaction with younger students, for whom many hope to act as mentors.

Contrary to popular opinion, when it comes to well-being, our lives do not represent an inevitable decline from the sunny uplands of youth to the valley of death. Instead, the opposite is true — we can confidently look forward to old age as the happiest time of our lives.

Contrary to popular opinion, when it comes to well-being, our lives do not represent an inevitable decline from the sunny uplands of youth to the valley of death. Instead, the opposite is true — we can confidently look forward to old age as the happiest time of our lives. So why do people grow happier as they age? Is it an absence of stress, or are they able to focus more on what brings them joy?

So why do people grow happier as they age? Is it an absence of stress, or are they able to focus more on what brings them joy?

Retirements must evolve because everything won’t work out as planned, says Carolyn Taylor, president of Weatherly Asset Management, an investment-management firm in Del Mar, Calif. One of her clients, who worked in the biotech industry and had a very busy family life, trained before retirement to become a master gardener. As she trained, she found that she enjoyed teaching others and finally became a teacher of gardening, Taylor says.

Retirements must evolve because everything won’t work out as planned, says Carolyn Taylor, president of Weatherly Asset Management, an investment-management firm in Del Mar, Calif. One of her clients, who worked in the biotech industry and had a very busy family life, trained before retirement to become a master gardener. As she trained, she found that she enjoyed teaching others and finally became a teacher of gardening, Taylor says.

Professional Canadian athlete Justin Kelly celebrates retirement by hitting the road on his motorcycle and enjoying the waves in Malibu. Share in Justin’s vision for sustaining his love for travel after retiring his #27 jersey and completing a remarkable ice hockey career.

Professional Canadian athlete Justin Kelly celebrates retirement by hitting the road on his motorcycle and enjoying the waves in Malibu. Share in Justin’s vision for sustaining his love for travel after retiring his #27 jersey and completing a remarkable ice hockey career.

A third of the nurses who took the survey are baby boomers and 20% of survey takers said they planned to retire in the next five years. More than a quarter, 27%, said they were unlikely to be working at their current job in a year.

A third of the nurses who took the survey are baby boomers and 20% of survey takers said they planned to retire in the next five years. More than a quarter, 27%, said they were unlikely to be working at their current job in a year. Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

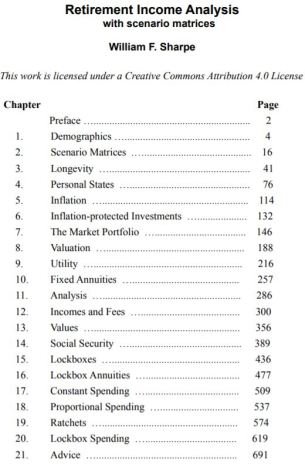

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision. Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.