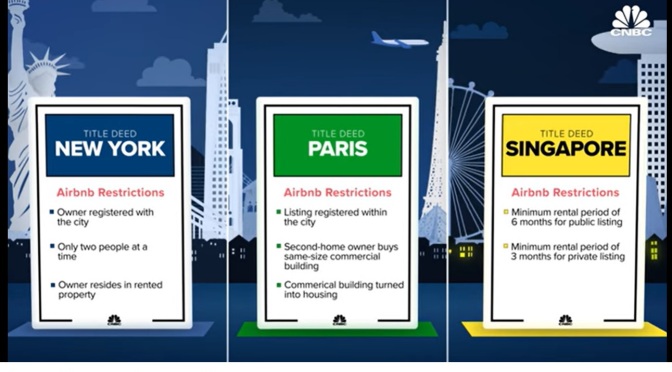

CNBC International (August 15, 2023) – In the Italian city of Venice, the number of beds dedicated to tourists is now almost on par with the number of beds allocated to residents.

An electronic counter installed by activists in the city tracking this number illustrates the ever-growing demand for short-term rentals, popularized by the home-sharing platform Airbnb, which is now as popular as hotels. The short-term rental market is projected to be worth $228.9 billion in 2030, boosted by the rise of commercial operators.

But as the housing crisis deepens worldwide due to land and labor shortages, residents are questioning the impact of Airbnbs and second homes locally. “We have more than 7,000 apartments involved in this kind of system of short-term tourist rentals.

And now it’s very difficult for a young guy or a new family to find an affordable house to rent,” Dario Nardella, Florence city mayor, told CNBC. So what is the economic impact of Airbnb and short-term rentals? And can restrictions ease the crisis? Watch the video to find out.

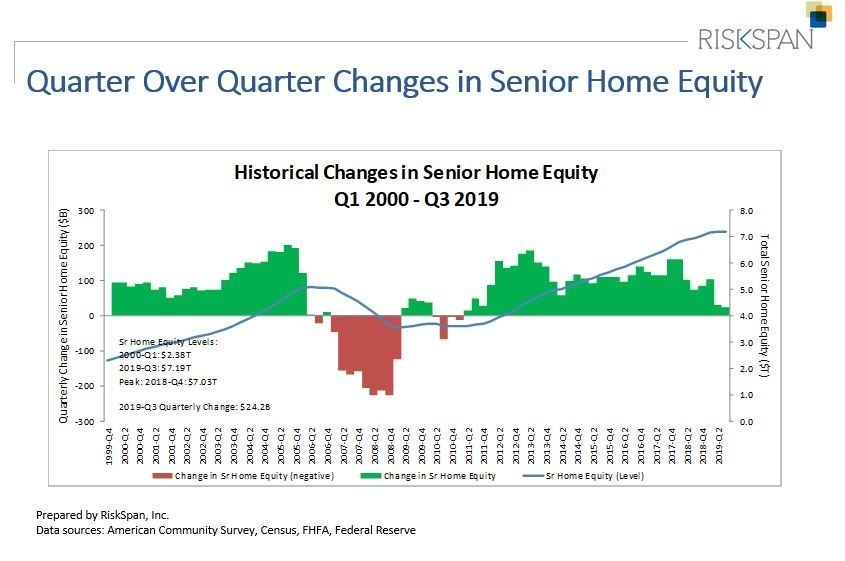

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”