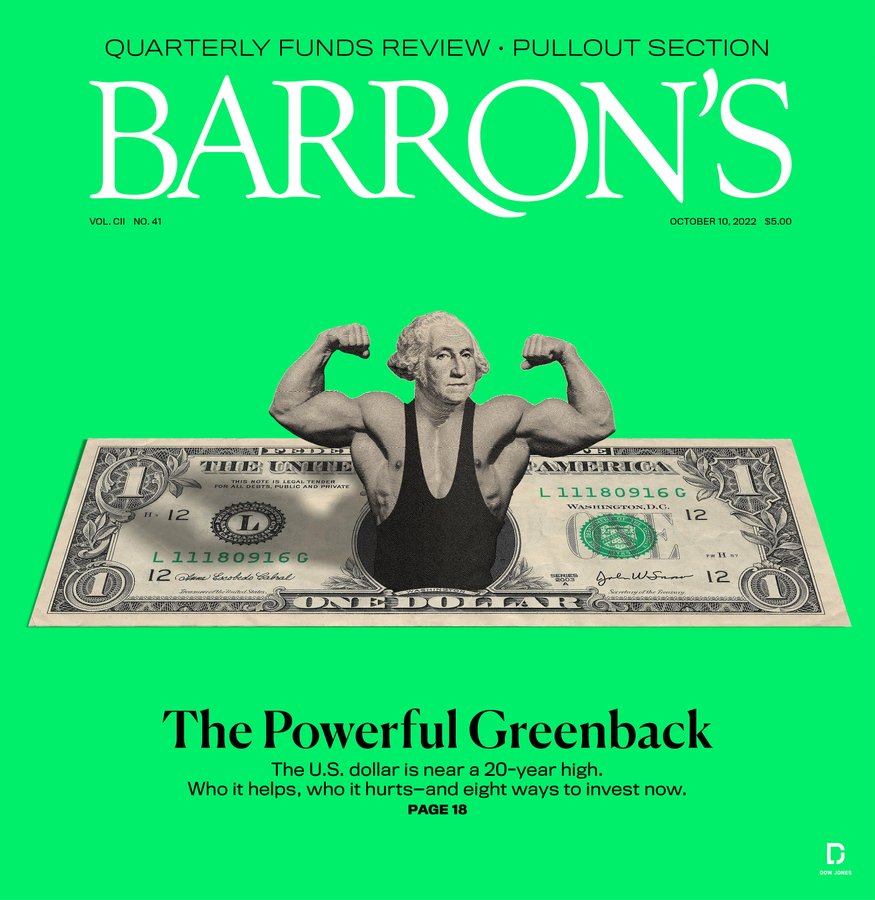

The U.S. Dollar Is Superstrong. 8 Ways to Invest Abroad

The U.S. dollar got a brief, welcome walloping this past week, falling 1.5% on Tuesday alone against a basket of six major currencies. It remains up a hefty 17% for the year, and close to its strongest level in decades. That matters for ordinary savers, and not just forex flippers.