Inside Barron’s November 7, 2022 Issue:

A Legacy Is on the Line as Musk Takes Over Twitter

Love him or hate him, the Tesla CEO is about to show whether Twitter can take flight under his ownership. More than his billions are at stake.

Inside Barron’s November 7, 2022 Issue:

Love him or hate him, the Tesla CEO is about to show whether Twitter can take flight under his ownership. More than his billions are at stake.

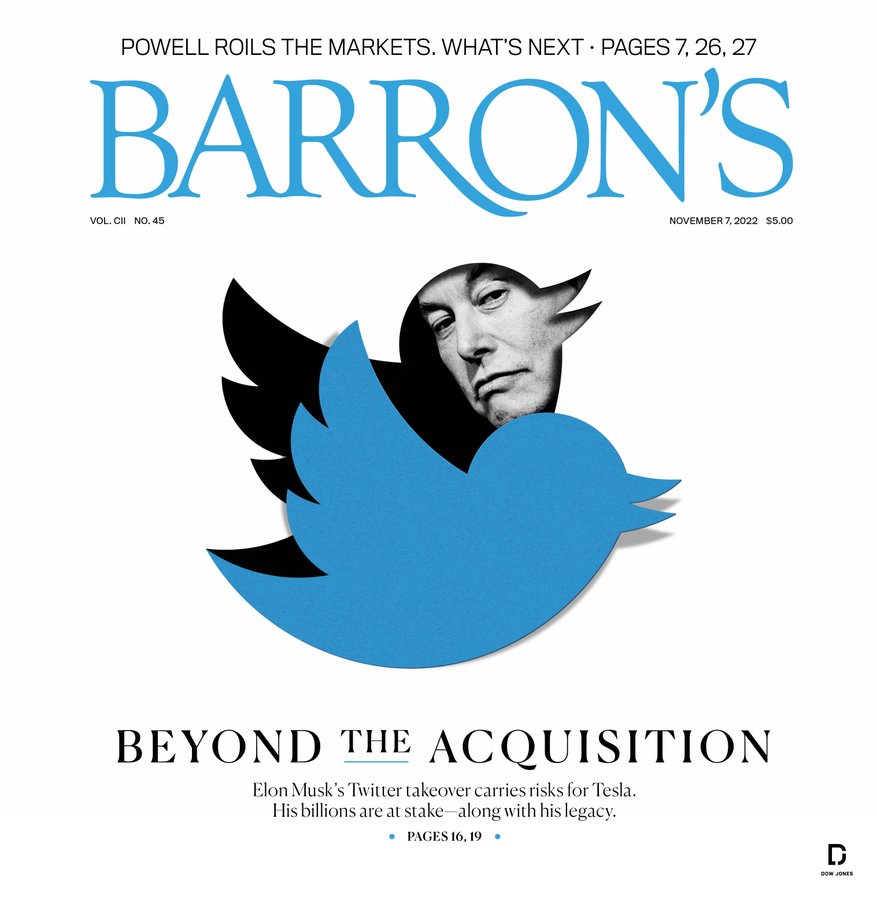

From tax legislation to the debt-ceiling debate, a lot is riding on the next Congress. What to expect from divided government.

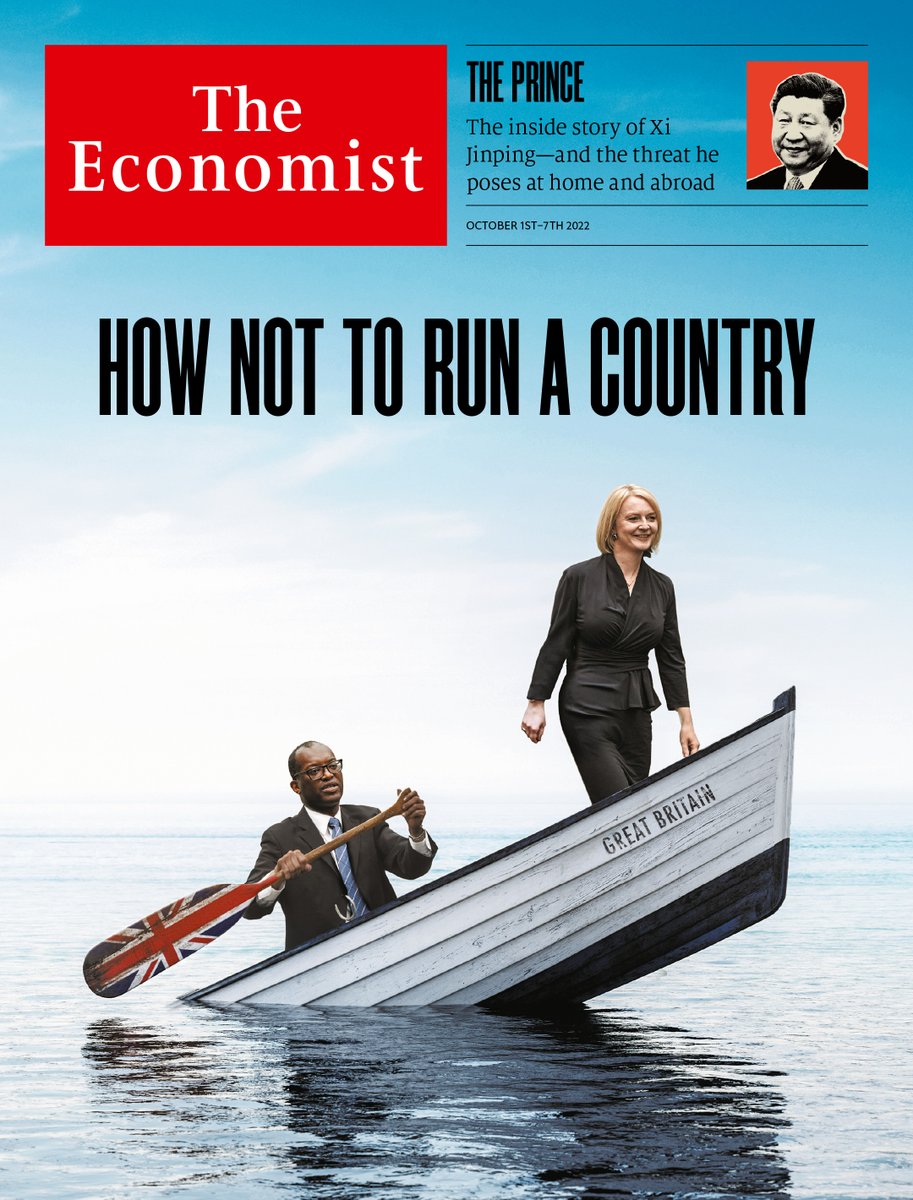

A country of political instability, low growth and subordination to the bond markets

In 2012 liz truss and Kwasi Kwarteng, two of the authors of a pamphlet called “Britannia Unchained”, used Italy as a warning. Bloated public services, low growth, poor productivity: the problems of Italy and other southern European countries were also present in Britain. Ten years later, in their botched attempt to forge a different path, Ms Truss and Mr Kwarteng have helped make the comparison inescapable. Britain is still blighted by disappointing growth and regional inequality. But it is also hobbled by chronic political instability and under the thumb of the bond markets. Welcome to Britaly.

Changes in the housing market are often delayed in inflation data, which can make things difficult for the Fed. Housing is one of the most weighted categories when tracking inflation, but it’s also one of the most complicated to measure. WSJ’s David Harrison explains how the shelter index is calculated, and why it can muddy the inflation outlook for the Fed. Illustration: Laura Kammermann

Its five-yearly congress will further tighten one man’s grip

It will be an orderly affair. From October 16th the grandees of China’s Communist Party will gather in the Great Hall of the People in Beijing for their five-yearly congress. Not a teacup will be out of place; not a whisper of protest will be audible. The Communist Party has always been obsessed with control. But under President Xi Jinping that obsession has deepened. After three decades of opening and reform under previous leaders, China has in many ways become more closed and autocratic under Mr Xi. Surveillance has broadened. Censorship has stiffened. Party cells flex their muscles in private firms. Preserving the party’s grip on power trumps any other consideration.

The U.S. dollar got a brief, welcome walloping this past week, falling 1.5% on Tuesday alone against a basket of six major currencies. It remains up a hefty 17% for the year, and close to its strongest level in decades. That matters for ordinary savers, and not just forex flippers.

A great rebalancing between governments and central banks is under way.

For months there has been turmoil in financial markets and growing evidence of stress in the world economy. You might think that these are just the normal signs of a bear market and a coming recession. But, as our special report this week lays out, they also mark the painful emergence of a new regime in the world economy—a shift that may be as consequential as the rise of Keynesianism after the second world war, and the pivot to free markets and globalisation in the 1990s.

The investment landscape is shifting. Here’s how to build a plan for long-term success—along with some stocks, bonds, and funds that can help you reach your goals.

Liz Truss’s new government may already be dead in the water

The Sunshine State has seen 40% of America’s hurricanes and a huge population boom

Randall W. Forsyth

TECHNOLOGY TRADER

Eric J. Savitz

THE TRADER

Nicholas Jasinski

INCOME INVESTING

Lawrence C. Strauss

STRIKING PRICE

Steven M. Sears

STREETWISE