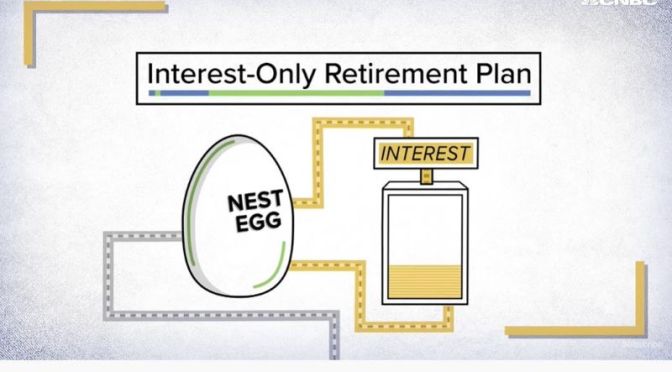

If you can save enough money now, you can fund your retirement by living off of your returns without draining your nest egg. Luckily, with time and dedication, you can make it happen. The official retirement age for most Americans is 67 years old. But that number largely matters for Social Security benefits. If you want to retire early, however, you will need a plan that relies primarily on your own savings and investments. CNBC crunched the numbers, and we can tell you how much you need to save now to safely get $75,000 of passive income every year in retirement. First, some ground rules. The numbers assume you will retire at 45, have no money in savings now and plan to save a substantial amount of income to reach your goal. For investing, we assume an annual 4% return when you are saving. We do not factor in inflation, taxes or any additional income you may get from Social Security and your 401(k). In retirement, we use the “4% rule,” which is a general principle that says you can comfortably withdraw 4% of your portfolio every year. It is important to note with the recent market volatility, there is a risk you’ll have to lower your spending percentage in the future. Check out this video to get a full breakdown of the numbers.

Tag Archives: Retirement

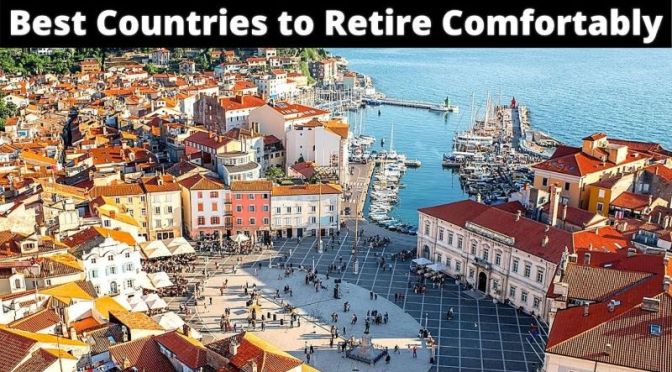

Retirement: ’12 Countries With Low Cost Of Living’

If you’re considering retirement abroad, you need information, and you need lots of it. But more than that, you need guidance on how to interpret that information. In many cases, you could decrease your monthly expenses, perhaps significantly, simply by relocating to a new country. Depending where in the world you choose to retire, you could enjoy big savings on housing, and other expenses. There are many tempting places in Europe, Latin America and Asia where you can live large on a small budget. You’ll also need to consider the visa application and residency process for moving to these countries. The countries mentioned in this video are some of the best option for retiring comfortably with low cost of living and access to healthcare. These countries are catching on quickly by attracting retirees with enticing retirement plans. So here are 12 Best countries to retire comfortably.

- Portugal

- Costa Rica

- Malaysia

- Ecuador

- Slovenia

- Thailand

- Greece

- Vietnam

- Mexico

- Philippines

- Uruguay

- Mauritius

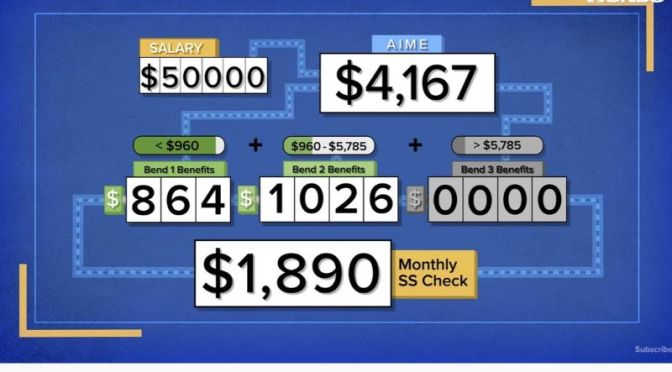

Retirement: How Monthly ‘Social Security’ Benefits Are Calculated (Video)

Planning to save for retirement might not be a priority. Luckily, you’ll have some help from Social Security. Different salaries can drastically raise or lower your Social Security benefits. Here’s how much you can expect, based on six different salaries. The average Social Security check in 2020 is $1,503. Figuring out how much you can expect every month when you retire depends on a few criteria. The size of your payment will be based on income from your working years, the year you were born and the age when you decide to start receiving benefits. Luckily, CNBC did the math for a wide range of salaries, and we can estimate your future benefits if you make between $30,000 and $100,000 per year. Remember: Social Security was not envisioned as your sole source of money for retirement, and the totals are always changing. Watch this video for a breakdown of how much you will get and how your monthly benefit will be calculated based on multiple different salaries.

Salaries: Why American Teachers Earn Much Less Than Other Professions

Teachers earn nearly 20% less than other professionals with similar education and experience, according to the Economic Policy Institute. In many states, their wages are below the living wage, forcing teachers to seek secondary jobs to supplement their income or leave the profession all together.

Since the outbreak of the coronavirus pandemic and the rise of remote learning, the challenges faced by educators has become increasingly demanding. Some organizations are trying to redesign teacher pay structures in some of the 13,500 public school districts nationwide. Watch the video above to learn more about why teachers are paid so little and how to fix that.

Post Covid: “The Future Of Elderly Care’ (Video)

Across the rich world around half of covid-19 deaths have been in care homes. Countries need to radically rethink how they care for their elderly—and some innovative solutions are on offer.

Retirement: ‘How Social Security Works’ (Video)

Since 2010, Social Security’s cash flow has been negative, meaning that the agency does not collect enough money through taxes to cover what it is paying out. Even though there was still this vast trust fund behind Social Security, they started tapping that fund’s interest.

Starting in 2021, they will have to dip into the trust fund itself to cover those benefit payments, and even that pool of cash has an expiration date. Trustees of the fund expect that by 2035 it will not be enough to cover full benefit payments. Due to COVID-19, that date may come years sooner than expected, which has some retirees seriously worried about their future.

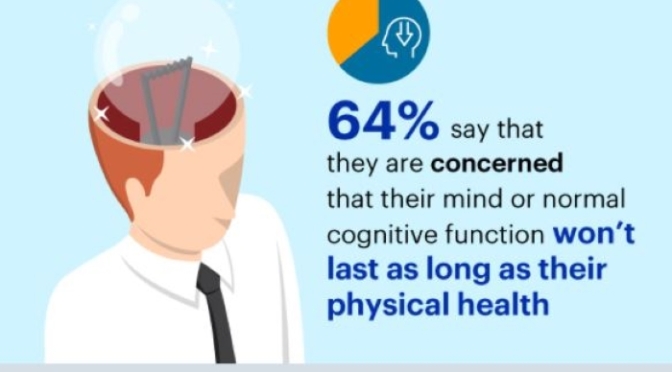

Infographic: Americans Feel ‘Old’ At 47, Fear Aging And Cognitive Decline

Retirement: Medicare, Medigap & Part D – Seniors Find Choices “Dizzying”

If you’re enrolled only in original Medicare with a Medigap supplemental plan, and don’t use a drug plan, there’s no need to re-evaluate your coverage, experts say. But Part D drug plans should be reviewed annually. The same applies to Advantage plans, which often wrap in prescription coverage and can make changes to their rosters of in-network health care providers.

“The amount of information that consumers need to grasp is dizzying, and it turns them off from doing a search,” Mr. Riccardi said. “They feel paralyzed about making a choice, and some just don’t think there is a more affordable plan out there for them.”

Is there another way?

When creation of the prescription drug benefit was being debated, progressive Medicare advocates fought to expand the existing program to include drug coverage, funded by a standard premium, similar to the structure of Part B. The standard Part B premium this year is $144.60; the only exceptions to that are high-income enrollees, who pay special income-related surcharges, and very low-income enrollees, who are eligible for special subsidies to help them meet Medicare costs.

“Given the enormous Medicare population that could be negotiated for, I think most drugs could be offered through a standard Medicare plan,” said Judith A. Stein, executive director of the Center for Medicare Advocacy.

“Instead, we have this very fragmented system that assumes very savvy, active consumers will somehow shop among dozens of plan options to see what drugs are available and at what cost with all the myriad co-pays and cost-sharing options,” she added.

Advocates like Ms. Stein also urged controlling program costs by allowing Medicare to negotiate drug prices with pharmaceutical companies — something the legislation that created Part D forbids.

Financial Videos: ‘Is Trump Or Biden Better For The Stock Market’ (CNBC)

The outcome of the 2020 election between Joe Biden and Donald Trump will likely have a major impact on the equity market. Although the economy has historically performed better under a Democratic president, that doesn’t always necessarily reflect on market performance. However, which party controls the White House can still be an important element for those looking to earn big in the market. So how does the U.S. election impact the stock market and how should investors prepare?

Mobile Lifestyle Video: The Rise Of Retirement-Age RV Nomad “Workcampers”

The pandemic has spurred surges in camping and RV travel due to the need for social distancing and outdoor activity. But it’s not all fun and vacations: one group of Americans adopted a self-sufficient and nomadic lifestyle long ago, living full-time in motor homes and working seasonal jobs to support themselves as they travel the United States. Paul Solman reports on retirement-age “workampers.”