Claremont Review of Books: The latest issue features ‘Special Anniversary Double Issue’….

Palace Intrigues

by Barry Strauss

Imagine sitting near the apex of power in an empire and then being shown the door. You might want to write a tell-all book about it. If so, however, you would be advised to proceed with caution. Now, imagine what would barely be conceivable today: that you undertook to write your exposé while you were still in office. You would need all the finesse of a tightrope walker.

The Lives of the Caesars

One Score and Five

by Charles R. Kesler

This essay is adapted from remarks delivered at the Claremont Review of Books 25th anniversary gala, held at the Metropolitan Club in New York City on November 6, 2025.

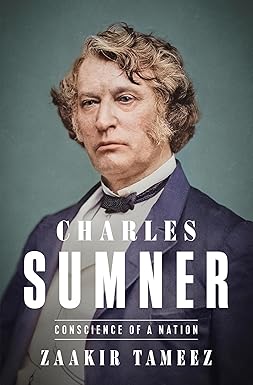

Radical Republican

by Randy E. Barnett

In the early hours of March 11, 1874, word spread around Washington that Charles Sumner was on the brink of death. The 63-year-old senator from Massachusetts had suffered a massive heart attack the previous evening. By 9 a.m., a crowd of several hundred had gathered in front of his home on Lafayette Square. “Colored men and women mingled with white in knots about his home,” wrote The New-York Tribune. Government workers, merchants, shopmen, waiters, and even “old colored women with baskets and bundles on their arms” stood together. Many were crying and begging to be let inside. They were stopped by one of Sumner’s friends and two policemen standing guard at the front door.