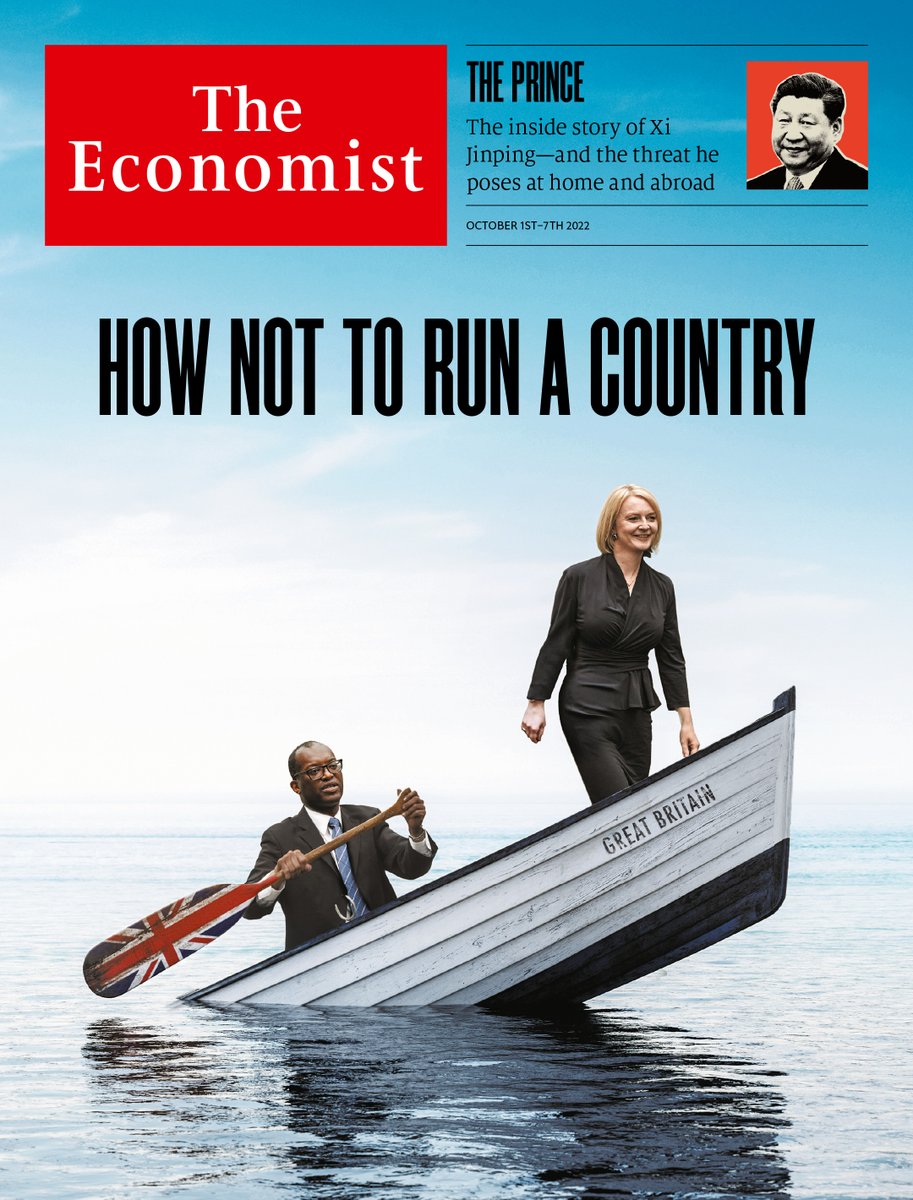

How not to run a country

Liz Truss’s new government may already be dead in the water

Hurricane Ian pummels Florida

The Sunshine State has seen 40% of America’s hurricanes and a huge population boom

Liz Truss’s new government may already be dead in the water

The Sunshine State has seen 40% of America’s hurricanes and a huge population boom

Randall W. Forsyth

TECHNOLOGY TRADER

Eric J. Savitz

THE TRADER

Nicholas Jasinski

INCOME INVESTING

Lawrence C. Strauss

STRIKING PRICE

Steven M. Sears

STREETWISE

It will be richer, more powerful—and more volatile

It has a window of opportunity to push Russian forces back

Randall W. Forsyth

Jack Hough

Nicholas Jasinski

The country made history in legalizing Bitcoin, but it is now suffering the consequences. What went wrong is a cautionary tale for crypto.

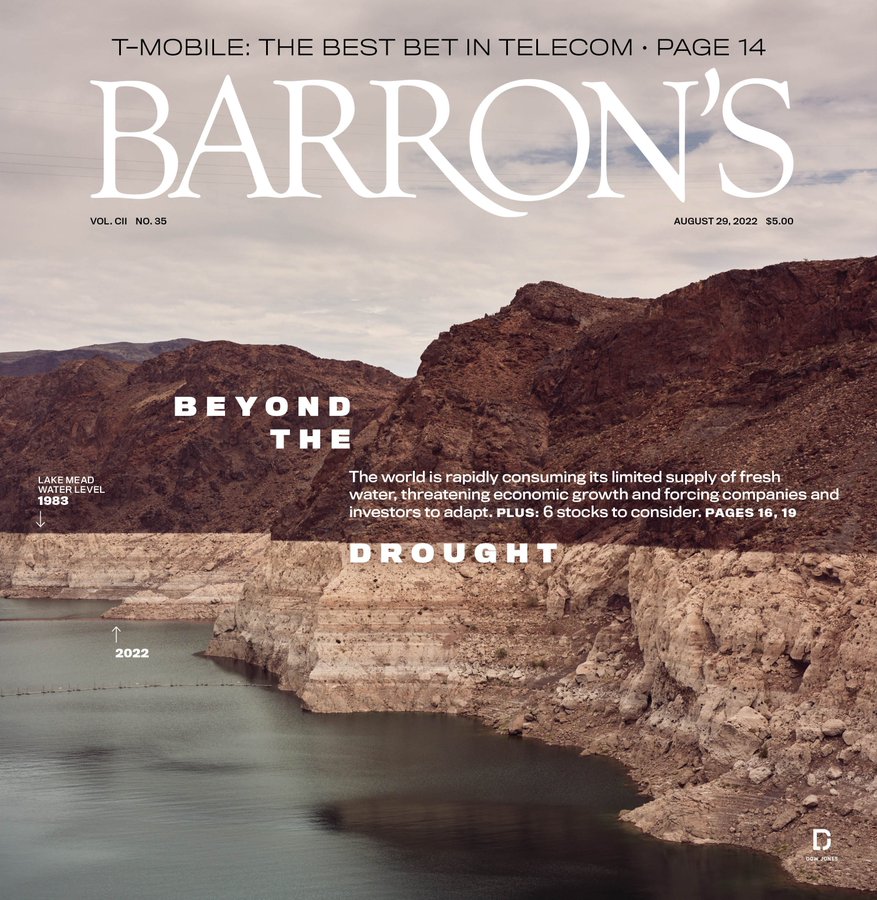

The scarcity of fresh water is rapidly emerging as a global economic threat that could disrupt businesses, crimp profits, and jeopardize growth. Companies, regulators, and investors are starting to react.

Ben Levisohn

Ben Levisohn

Al Root

Eric J. Savitz

The U.S. climate bill, along with a parallel initiative in Europe, could reshape global energy. Plug Power, Sunrun, and other companies could make the most of the new opportunities in renewables.

UP AND DOWN WALL STREET

Andrew Bary

UP AND DOWN WALL STREET

Andrew Bary

UP AND DOWN WALL STREET

Andrew Bary

THE TRADER

Joe Light

THE TRADER

Ben Levisohn

UP AND DOWN WALL STREET

Randall W. Forsyth

STREETWISE

Jack Hough

TECHNOLOGY TRADER

Eric J. Savitz

Budget constraints have gone missing. That presents both danger and opportunity

It is sometimes said that governments wasted the global financial crisis of 2007-09 by failing to rethink economic policy after the dust settled. Nobody will say the same about the covid-19 pandemic. It has led to a desperate scramble to enact policies that only a few months ago were either unimaginable or heretical. A profound shift is now taking place in economics as a result, of the sort that happens only once in a generation. Much as in the 1970s when clubby Keynesianism gave way to Milton Friedman’s austere monetarism, and in the 1990s when central banks were given their independence, so the pandemic marks the start of a new era. Its overriding preoccupation will be exploiting the opportunities and containing the enormous risks that stem from a supersized level of state intervention in the economy and financial markets.

A selection of three essential articles read aloud from the latest issue of The Economist. This week, why ESG should be boiled down to emissions, why the Tory leadership race should focus on Britain’s growth challenge (10:00), and how software developers aspire to forecast who will win a battle (18:20).