From a TechCrunch.com online article:

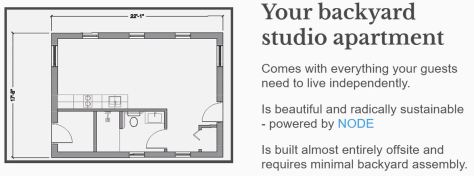

Rent the Backyard works with a partner to build the apartment, finances the construction, lists the property, selects the tenant, collects the rent and serves as the landlord. In exchange for all that, it has an ownership stake in the unit and keeps 50% of the rent.

Rent the Backyard works with a partner to build the apartment, finances the construction, lists the property, selects the tenant, collects the rent and serves as the landlord. In exchange for all that, it has an ownership stake in the unit and keeps 50% of the rent.

The startup also handles the permitting, which co-founder Spencer Burleigh said has become much easier with recent changes in California law. In fact, he pointed to stories about how these changes have led to skyrocketing applications (16 in 2016, 350 in 2018) to build “in-law” units in San Jose, which is where the startup is focused for now.

To read more click on following link: https://techcrunch.com/2019/07/18/rent-the-backyard/?utm_medium=TCnewsletter&tpcc=TCdailynewsletter

While it may be unassuming, B.T.’s is hardly undiscovered. The lines get long, so time your trip to hit the smokehouse when it opens at 11 a.m. or during the late-afternoon lull. Order your meat to go, grab a beer at the convenience store next door, and park yourself on the hood of your car, the curb, or anywhere you can find a spot. It isn’t glamorous, but it is astonishingly good.

While it may be unassuming, B.T.’s is hardly undiscovered. The lines get long, so time your trip to hit the smokehouse when it opens at 11 a.m. or during the late-afternoon lull. Order your meat to go, grab a beer at the convenience store next door, and park yourself on the hood of your car, the curb, or anywhere you can find a spot. It isn’t glamorous, but it is astonishingly good.

“Umbrella is an app that’s meant to connect these people with each other, through a marketplace with a membership model. The app lets seniors sign up for “jobs” and provide their services, like mowing a lawn or painting a fence.

“Umbrella is an app that’s meant to connect these people with each other, through a marketplace with a membership model. The app lets seniors sign up for “jobs” and provide their services, like mowing a lawn or painting a fence.

Residents can enjoy four beautiful seasons in Flagstaff, says Meg Roederer, of the Flagstaff Convention and Visitors Bureau. She graduated from Northern Arizona University (located at the heart of Flagstaff) 30 years ago and never looked back. “Between the student, professional and retirement populations, the city has a real vibrancy,” she says. Don’t be fooled by downtown Flagstaff’s sleepy western vibe. “It’s really a mountain-foodie town,” Roederer says. It has more than 200 restaurants and award-winning craft beers in abundance along a “brewery trail.”

Residents can enjoy four beautiful seasons in Flagstaff, says Meg Roederer, of the Flagstaff Convention and Visitors Bureau. She graduated from Northern Arizona University (located at the heart of Flagstaff) 30 years ago and never looked back. “Between the student, professional and retirement populations, the city has a real vibrancy,” she says. Don’t be fooled by downtown Flagstaff’s sleepy western vibe. “It’s really a mountain-foodie town,” Roederer says. It has more than 200 restaurants and award-winning craft beers in abundance along a “brewery trail.”