Since 1980, pensions plans have been phased out in favor of 401(k) plans. They now represent nearly one-fifth of the U.S. retirement market. So how did 401(k) plans become such a popular form of retirement savings and how should they be used? Watch the video to find out.

Category Archives: Investing

Stock Market: ‘GameStop & Payment For Order Flow’

Following the GameStop trading frenzy, the SEC is expected to take a fresh look at payment for order flow, a decades-old practice that’s at the heart of how commission-free trading works. WSJ explains what it is, and why critics say it’s bad for investors. Illustration: Jacob Reynolds/WSJ

Retirement: How To Get To $75K/Yr In Passive Income

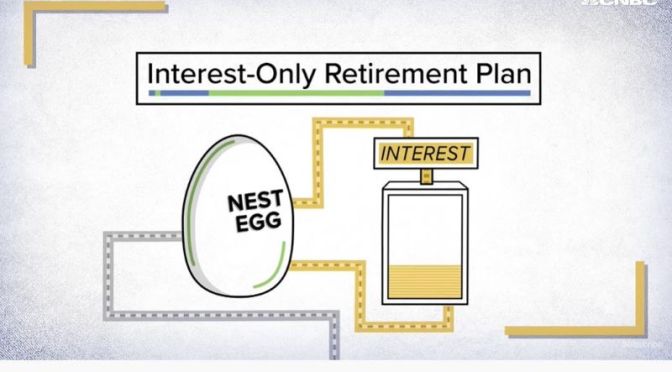

If you can save enough money now, you can fund your retirement by living off of your returns without draining your nest egg. Luckily, with time and dedication, you can make it happen. The official retirement age for most Americans is 67 years old. But that number largely matters for Social Security benefits. If you want to retire early, however, you will need a plan that relies primarily on your own savings and investments. CNBC crunched the numbers, and we can tell you how much you need to save now to safely get $75,000 of passive income every year in retirement. First, some ground rules. The numbers assume you will retire at 45, have no money in savings now and plan to save a substantial amount of income to reach your goal. For investing, we assume an annual 4% return when you are saving. We do not factor in inflation, taxes or any additional income you may get from Social Security and your 401(k). In retirement, we use the “4% rule,” which is a general principle that says you can comfortably withdraw 4% of your portfolio every year. It is important to note with the recent market volatility, there is a risk you’ll have to lower your spending percentage in the future. Check out this video to get a full breakdown of the numbers.

Investments: Why ‘Bitcoin’ Is Soaring In Value (Video)

The price of bitcoin is skyrocketing, driving a rally of momentum trading that’s pushed its value higher than it’s ever been before. WSJ explains how bitcoin trading works, and why the volatile digital currency is reaching all-time highs. Illustration: Jacob Reynolds/WSJ

Investing: “The Volatility In The Gold Market Explained” (WSJ Video)

The price of gold is going haywire, driving a frenzy of investment that’s calling into question the metal’s reputation as a safe-haven during times of economic uncertainty.

WSJ Explains. Illustration: Liz Ornitz/WSJ

Business: “How Tesla Became Most Valuable Auto Company” (WSJ Video)

Tesla’s stock has more than tripled since the start of the year, giving it a market capitalization larger than many behemoths of American industry. But its rise wasn’t necessarily driven by fundamentals. WSJ explains.

Illustration: Jacob Reynolds/WSJ

Investment Portfolios: Health Care Stocks For Boomers To Invest In

“To cash in on these long-term trends, we scoured the sector and found eight good opportunities. The stocks we like fall into three broad health care areas: drugmakers, health care service providers, and medical device and equipment manufacturers. Their share prices may continue to bounce around, especially as we near the 2020 elections. Smart investors will buy more when shares dip. “If you have flexibility and you can pick your spots, you can make money,” says Matt Benkendorf, chief investment officer at money management firm Vontobel Quality Growth.”

- Merck (symbol MRK, price $83) is an elder statesman in the pharma world that should continue to thrive in the new order. Keytruda, Merck’s immunotherapy drug that basically gets the immune system to kill cancer cells, is “rapidly becoming one of the largest products we’ve ever seen,” says JPMorgan Chase analyst Christopher Thomas Schott.

- Neurocrine Biosciences (NBIX, $84) is expected to be profitable in 2020. It has two drugs on the market and a strong pipeline of therapies in all stages of development. One of its commercial drugs, Ingrezza, is a “best in class” therapy for tardive dyskinesia, a condition that causes jerky, involuntary face and body movements, says Credit Suisse’s Seigerman. He thinks it could fetch annual sales of $2 billion by the early 2020s.

- CVS Health (CVS, $54) aims to give UnitedHealth a run for its money. It’s best known for its drugstores—70% of people in the U.S. live within three miles of a CVS pharmacy—but it operates more than 1,000 walk-in clinics, too. With its acquisition of Aetna in late 2018, CVS is now also an insurer.

- After spinning off its drug division in 2013, Abbott Laboratories (ABT, $82) now focuses on a diverse roster of products that includes nutritional drinks, diagnostics, generic drugs and medical devices. But a trio of new products put it in the sweet spot of the health care sector’s innovation surge, says William Blair’s Golan.

Read more in Kiplinger’s: https://www.kiplinger.com/article/investing/T052-C000-S002-9-health-care-stocks-for-your-portfolio.html