The coronavirus pandemic has forced many Americans to accept new financial realities. WSJ’s Shelby Holliday traveled to a diverse neighborhood in Philadelphia to learn how neighbors are facing different struggles brought on by the same virus. Photo: Adam Falk/The Wall Street Journal

Category Archives: Financial

Financial Videos: ‘Is Trump Or Biden Better For The Stock Market’ (CNBC)

The outcome of the 2020 election between Joe Biden and Donald Trump will likely have a major impact on the equity market. Although the economy has historically performed better under a Democratic president, that doesn’t always necessarily reflect on market performance. However, which party controls the White House can still be an important element for those looking to earn big in the market. So how does the U.S. election impact the stock market and how should investors prepare?

Public Investigations: “The Financial Crisis At The U.S. Postal Service” (WSJ Video)

More than a decade of losses have put the U.S. Postal Service in a dire financial situation. To understand how this happened, WSJ takes a look back at how the modern postal service became an entity balancing public service and the need for profit.

Photo Illustration: Jacob Reynolds/WSJ

Online Payments: What Is The Chinese App “Alipay” From “Ant”? (WSJ Video)

The Chinese fintech titan Ant Group—co-founded by Alibaba billionaire Jack Ma—is set to go public in what could be one of the largest listings ever. WSJ explains how Ant’s backbone service, Alipay, has revolutionized payments and investing in the world’s most populous country.

Photo Composite: Crystal Tai

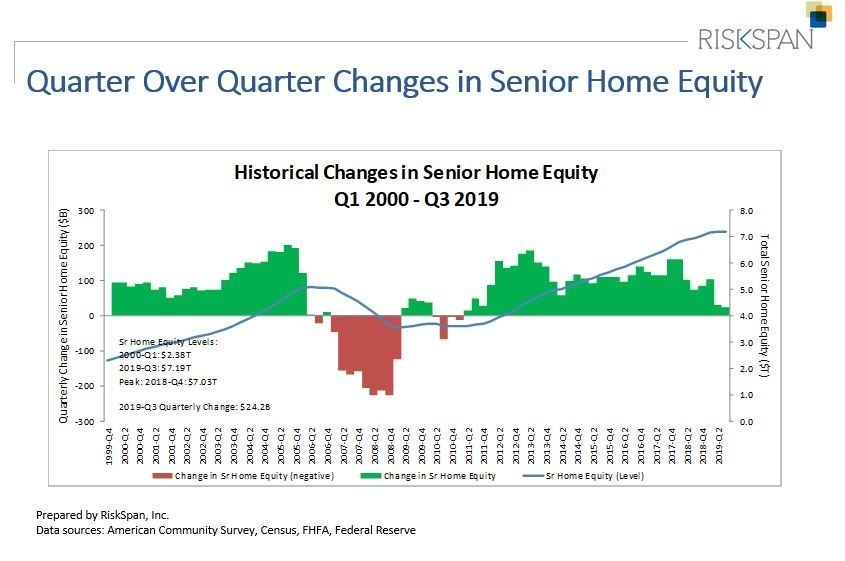

Housing Market: Seniors’ Home Equity Rises $24 Billion In 3rd Quarter 2019 To All-Time High

From a NRMLA online news release:

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”

(December 17, 2019) – Homeowners 62 and older saw their housing wealth grow by 0.3 percent or $24 billion in the third quarter to a record $7.19 trillion from Q2 2019, the National Reverse Mortgage Lenders Association reported today in its quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

The RMMI rose in Q3 2019 to 259.19, another all-time high since the index was first published in 2000. The increase in senior homeowners’ wealth was mainly driven by an estimated 0.5 percent or $40.7 billion increase in senior home values, offset by a one percent or $16.5 billion increase of senior-held mortgage debt.

To read more: https://www.nrmlaonline.org/about/press-releases/senior-housing-wealth-reaches-record-7-19-trillion

Economics & Finance: “Economics For People” With Cambridge Author & Professor Ha-Joon Chang (New INET Video Series)

In the new series “Economics For People” from the Institute for New Economic Thinking (INET), University of Cambridge economist and bestselling author Ha-Joon Chang explains key concepts in economics, empowering anyone to hold their government, society, and economy accountable.

In the new series “Economics For People” from the Institute for New Economic Thinking (INET), University of Cambridge economist and bestselling author Ha-Joon Chang explains key concepts in economics, empowering anyone to hold their government, society, and economy accountable.

Lecture 1.1: The Nature of Economics

Lecture 1.2: Five Reasons Why Economics Is Political

Lecture 2: What Is Wrong With Globalization?

To view more videos: https://www.ineteconomics.org/perspectives/videos/economics-for-people

Economic Debates: “The Pension Crisis – State And Local Challenges” (Univ. Of Chicago Video)