Watch a Q&A with Steven Chu, who’s devoted a large part of his scientific career to searching for solutions to our climate challenges.

- 0.06 – What does sustainability mean to you?

- 0.34 – What are the present challenges in sustainability?

- 1.50 – How can we help every person see the importance of being sustainable?

- 3.24 – What can I do to be more sustainable in my everyday life?

- 5.22 – What’s the most sustainable form of energy in your opinion?

- 6.44 – How do you try to do research in the lab in a sustainable way?

- 8.34 – Where do you see our world’s climate status in 50 years?

- 10.19 – Do you feel hope in humanity when it comes to tackling climate change?

Steven Chu born February 28, 1948) is an American physicist and a former government official. He is known for his research at the University of California at Berkeley and his research at Bell Labs and Stanford University regarding the cooling and trapping of atoms with laser light, for which he won the Nobel Prize in Physics in 1997, along with his scientific colleagues Claude Cohen-Tannoudji and William Daniel Phillips.

Chu served as the 12th United States Secretary of Energy from 2009 to 2013. At the time of his appointment as Energy Secretary, Chu was a professor of physics and molecular and cellular biology at the University of California, Berkeley, and the director of the Lawrence Berkeley National Laboratory, where his research was concerned primarily with the study of biological systems at the single molecule level. Chu resigned as energy secretary on April 22, 2013. He returned to Stanford as Professor of Physics and Professor of Molecular & Cellular Physiology.

Chu is a vocal advocate for more research into renewable energy and nuclear power, arguing that a shift away from fossil fuels is essential to combating climate change. He has conceived of a global “glucose economy”, a form of a low-carbon economy, in which glucose from tropical plants is shipped around like oil is today. On February 22, 2019, Chu began a one-year term as president of the American Association for the Advancement of Science.

Bio from Wikipedia

Bertrand Arthur William Russell, 3rd Earl Russell (18 May 1872 – 2 February 1970) was a British philosopher, logician, mathematician, historian, writer, essayist, social critic, political activist, and Nobel laureate. At various points in his life, Russell considered himself a liberal, a socialist and a pacifist, although he also confessed that his sceptical nature had led him to feel that he had “never been any of these things, in any profound sense.” Russell was born in Monmouthshire into one of the most prominent aristocratic families in the United Kingdom.

Bertrand Arthur William Russell, 3rd Earl Russell (18 May 1872 – 2 February 1970) was a British philosopher, logician, mathematician, historian, writer, essayist, social critic, political activist, and Nobel laureate. At various points in his life, Russell considered himself a liberal, a socialist and a pacifist, although he also confessed that his sceptical nature had led him to feel that he had “never been any of these things, in any profound sense.” Russell was born in Monmouthshire into one of the most prominent aristocratic families in the United Kingdom.

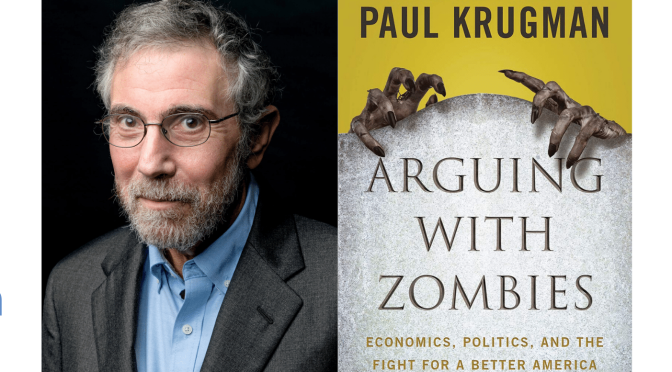

Bloomberg Opinion columnist Barry Ritholtz interviews economist, bestselling author and New York Times columnist Paul Krugman, whose most recent book is “Arguing With Zombies: Economics, Politics, and the Fight for a Better Future.”

Bloomberg Opinion columnist Barry Ritholtz interviews economist, bestselling author and New York Times columnist Paul Krugman, whose most recent book is “Arguing With Zombies: Economics, Politics, and the Fight for a Better Future.”  Paul Robin Krugman (born February 28, 1953) is an American economist who is the Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for The New York Times. In 2008, Krugman was awarded the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory and New Economic Geography. The Prize Committee cited Krugman’s work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of economies of scale and of consumer preferences for diverse goods and services.

Paul Robin Krugman (born February 28, 1953) is an American economist who is the Distinguished Professor of Economics at the Graduate Center of the City University of New York, and a columnist for The New York Times. In 2008, Krugman was awarded the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory and New Economic Geography. The Prize Committee cited Krugman’s work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of economies of scale and of consumer preferences for diverse goods and services.

The podcast team share some of their highlights from the past 12 months:

The podcast team share some of their highlights from the past 12 months:

Three-quarters of a century later, at age 97, Goodenough will become the oldest person

Three-quarters of a century later, at age 97, Goodenough will become the oldest person

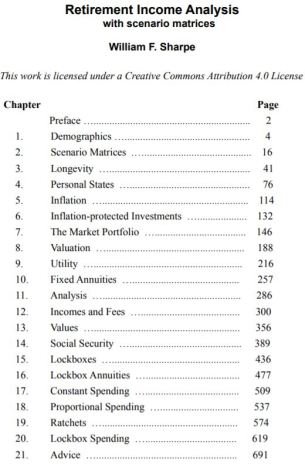

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision. Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.