Election Day Is Almost Here. What’s at Stake for the Economy.

From tax legislation to the debt-ceiling debate, a lot is riding on the next Congress. What to expect from divided government.

From tax legislation to the debt-ceiling debate, a lot is riding on the next Congress. What to expect from divided government.

Fed officials are considering the timeline of a potential slowdown in interest-rate hikes, according to a Wall Street Journal report. Bond yields moved off their highs.

Tesla’s stock has been in a tailspin. But if the electric-vehicle maker is able to navigate a few bumpy months, it will be a signal that it’s headed in the right direction.

A recession in 2023 would put banks back on their heels after a strong recovery from the pandemic. Sticking with the battleships may be best.

A state long known for liberal policies is advancing the most progressive economic and social agenda in a generation. Some companies are moving out.

Our latest Big Money poll of professional investors finds many bearish about stocks in the near term, but bullish about the market’s longer-term outlook.

Their stocks are down, but regional banks have solid businesses, ample capital, and payouts attractive to income investors.

The U.S. dollar got a brief, welcome walloping this past week, falling 1.5% on Tuesday alone against a basket of six major currencies. It remains up a hefty 17% for the year, and close to its strongest level in decades. That matters for ordinary savers, and not just forex flippers.

The investment landscape is shifting. Here’s how to build a plan for long-term success—along with some stocks, bonds, and funds that can help you reach your goals.

Randall W. Forsyth

TECHNOLOGY TRADER

Eric J. Savitz

THE TRADER

Nicholas Jasinski

INCOME INVESTING

Lawrence C. Strauss

STRIKING PRICE

Steven M. Sears

STREETWISE

Randall W. Forsyth

Jack Hough

Nicholas Jasinski

The country made history in legalizing Bitcoin, but it is now suffering the consequences. What went wrong is a cautionary tale for crypto.

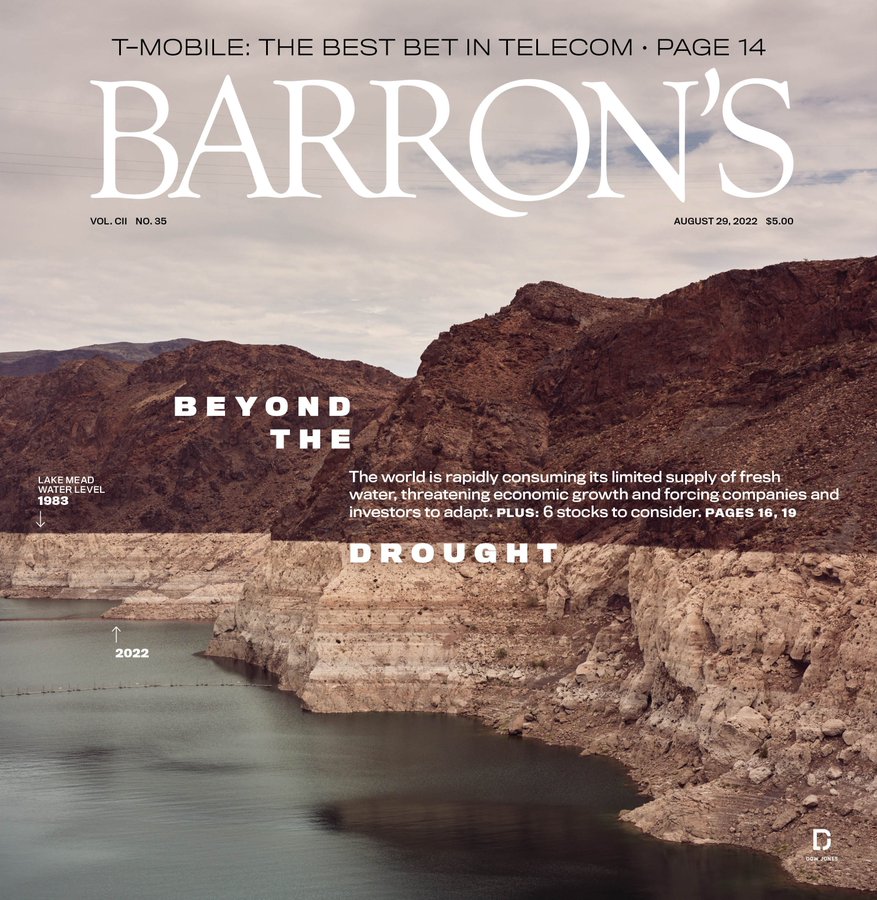

The scarcity of fresh water is rapidly emerging as a global economic threat that could disrupt businesses, crimp profits, and jeopardize growth. Companies, regulators, and investors are starting to react.

Ben Levisohn

Ben Levisohn

Al Root

Eric J. Savitz

The U.S. climate bill, along with a parallel initiative in Europe, could reshape global energy. Plug Power, Sunrun, and other companies could make the most of the new opportunities in renewables.

UP AND DOWN WALL STREET

Andrew Bary

UP AND DOWN WALL STREET

Andrew Bary

UP AND DOWN WALL STREET

Andrew Bary

THE TRADER

Joe Light

Panelists are split on where the economy and markets are headed, but agree this year’s selloff has left plenty of bargains.