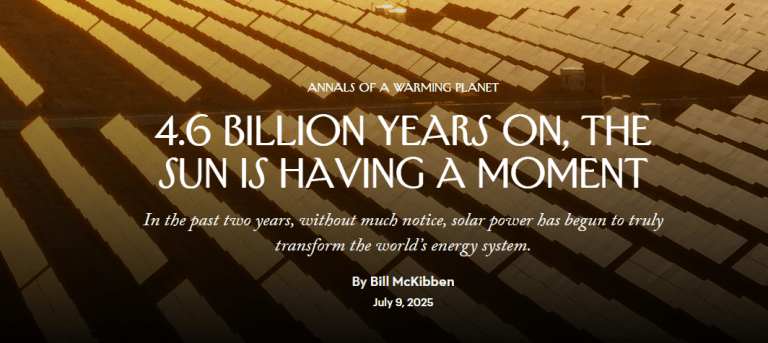

The following essay review was written by AI and edited by Intellicurean from a New Yorker article titled “4.6 Billion Years On, The Sun Is Having A Moment”, by Bill McKibben from his forthcoming book “Here Comes The Sun”.

Much like a seasoned playgoer at a modern drama, we find ourselves watching the improbable and the inevitable perform a dizzying pas de deux. For decades, renewable energy existed on the fringe—a topic for earnest environmentalists, academic dreamers, and early adopters armed with more zeal than capital. One recalls the almost quaint marvel of the first all-solar house at the University of Delaware in 1973, drawing curious crowds like pilgrims to a modern oracle. It was a novelty, an “alternative” to the fossil-fueled behemoth that powered Western economies for two centuries. And “alternative” was the key word—suggesting not a contender, but a polite afterthought.

Yet as we move through the mid-2020s, a stunning twist has unfolded, largely unnoticed amid louder headlines. With little fanfare, renewable energy has shifted from a peripheral ideal to a mainstream economic reality. In a world often held hostage to political drama and climate paralysis, this shift—documented in a recent New Yorker piece drawn from Bill McKibben’s forthcoming book, Here Comes the Sun: A Last Chance for the Climate and a Fresh Chance for Civilization (August 2025)—feels both miraculous and overdue. What was once “too good to be true” is now simply true. Solar, wind, and battery storage have become the most cost-efficient, fastest-growing power sources on Earth. The implications are nothing short of a new Industrial Revolution—only this time, it’s clean, decentralized, and increasingly democratic.

The Solar Surge

The statistics McKibben explores in the excerpted material are not dry metrics—they’re signals of an epochal shift. It took nearly seventy years from the invention of the photovoltaic cell in 1954 to reach the first terawatt of installed solar power by 2022. The second terawatt arrived by 2024. The third? Expected by 2026. Solar is now being added at a rate of one gigawatt—equivalent to a coal plant—every fifteen hours. Wind power, a cousin to solar in its dependence on planetary physics, isn’t far behind.

Globally, renewables met 96% of new electricity demand in the past year. In the U.S., the figure was 93%. Fossil fuels, once the uncontested monarchs of modernity, are losing their crown. In March, for the first time, fossil fuels generated less than half of all U.S. electricity.

California provides a dramatic case study. In May, the state—now the fourth-largest economy in the world—hit a record: renewable sources produced 158% of its power demand. Over the entire day, they delivered 82% of electricity consumed. This wasn’t theoretical progress—it was operational proof.

Batteries and the Grid Reimagined

Equally revolutionary is the rise of energy storage. Battery deployment has surged 76% this year alone. These systems often act as California’s overnight power source, stabilizing the grid when sunlight fades or wind slows. One official from the North American Electric Reliability Corporation noted, “batteries can smooth out some of that variability from those times when the wind isn’t blowing or the sun isn’t shining.” The result? California now uses 40% less natural gas than it did just last year—a number McKibben hails as “the single most hopeful statistic I’ve seen in four decades of writing about the climate crisis.”

Even Texas, synonymous with oil and gas, is rapidly rebranding its energy identity. In March, it set records for solar, wind, and battery output. During a brutal May heatwave, over a quarter of its power came from renewables. By adding 10,000 megawatts of clean capacity, Texas slashed emergency blackout risk from 16% last year to less than 1% now. This isn’t green idealism—it’s grid-level, boots-on-the-ground practicality.

China and the Global Cascade

But the scale of change in the U.S. pales in comparison to what’s happening in China. More than half the world’s renewables and batteries are now installed within Chinese borders. In May alone, China added 93 gigawatts of solar—equivalent to one gigawatt every eight hours. The environmental payoff is immediate: carbon emissions dropped in the first quarter of 2025, with electricity-linked emissions falling nearly 6% as solar and wind displaced coal. Nearly half of all vehicles sold in China this year were electric or hybrid.

This trend isn’t isolated—it’s contagious. South America, once planning 15 new coal plants, now plans none. India’s solar output surged so rapidly in early 2025 that coal consumption plateaued while natural gas use fell by a quarter. Even Poland, long a coal bastion, saw solar outstrip coal in May. These aren’t anomalies—they’re geopolitical rewrites.

And why? Because solar is now the cheapest, fastest path to power. China’s relentless innovation has driven battery costs down by 95% in 15 years. In just the first half of 2024, the U.S. alone added 4 gigawatts of storage. A Chinese utility’s latest bidding round cut prices by another 30%. Grid-scale batteries now power entire cities for hours. Nations that ignore this transformation aren’t just polluting—they’re rendering themselves globally uncompetitive.

Even petro-states have noticed. Saudi Arabia, Qatar, and the UAE are all building massive solar fields. Their goal? 50% of electricity from solar by 2050. When oil empires go solar, the narrative has changed.

Forecasts vs. Reality

As with all revolutions, hindsight exposes how blind the experts were. In 2009, the International Energy Agency predicted 244 gigawatts of solar by 2030. That benchmark was reached by 2015. Their forecasts over the last decade missed by an average of 235%. The only group that got it close? Greenpeace.

Jenny Chase of Bloomberg, quoted in the book, admitted: “If you’d told me nearly 20 years ago what would be the case now… I would have laughed in your face.” The contrast between establishment analysts and environmentalists makes for a satisfying, if sobering, moment of vindication.

Leapfrogging the Fossil Age

Perhaps the most radical reordering is happening in places least expected. In Pakistan, widespread solar adoption is quietly displacing national grid demand—not from recession, but from progress. Diesel sales are down 30%. Corn farmers now gift solar inverters as wedding dowries. Panels are laid flat on the earth without costly mounts. DIY TikTok tutorials fill the role of training programs. This is grassroots ingenuity—climate transition as community-driven liberation.

A similar story is emerging across Africa. In Namibia and Eswatini, rooftop solar accounts for 11–15% of peak electricity. In South Africa, small-scale solar now contributes nearly 20% of national grid capacity. Many of these systems go unreported, installed informally by citizens weary of blackouts. As energy analyst Joel Nana puts it: “This is happening anyway, whether you like it or not.”

The Limits—And Why They’re Not So Limiting

What of minerals? What of land? These limits, once feared fatal, now seem manageable.

Lithium, long considered a bottleneck, has seen prices drop even as demand rises. New sources have been discovered. More importantly, recycling systems are maturing. A 2023 Energy Transitions Commission report found that all materials needed to reach net zero by 2050 amount to less than the coal burned in a single year. Battery tech is also becoming more efficient—using less lithium, less silver, and recovering more materials post-use. One roof of solar panels can now power ten replacements over 25 years. That’s not just sustainability—it’s a virtuous cycle.

Land, too, is more abundant than assumed. Rooftops and parking lots help, but a more powerful solution lies in reclaiming farmland used for ethanol. A single acre of solar produces as much energy as 100 acres of corn-based ethanol. Cornell researchers found that converting under half of U.S. ethanol fields could decarbonize the entire grid by 2050. That’s not fantasy. That’s arithmetic.

Policy vs. Physics

The obstacles now aren’t technical—they’re political. Thousands of renewable projects are stuck in “interconnection queues,” awaiting utility approval. The Biden Administration has taken steps to clear these logjams. But the Trump Administration is actively trying to reverse course, propping up coal and gas, and demonizing renewables. One appointee—formerly a fracking executive—labeled solar “a parasite on the grid.” That’s not science. That’s theater.

Ironically, such obstruction may accelerate the global transition. Nations are increasingly wary of U.S. energy instability and looking elsewhere. Wall Street sees the trend clearly: renewables are not just climate solutions, but hedges against geopolitical volatility. A 2023 global poll found that 68% of people support solar energy—five times more than fossil fuels. Even among likely Trump voters, 87% support clean energy tax credits. The political class may dither, but the public is marching forward.

The Future Is Diffuse, Not Centralized

The most profound feature of this transition may be its structure. Fossil fuels are scarce, located in select pockets, and easy to monopolize. But solar and wind are everywhere. You can’t own the sun. You can’t weaponize the wind. What this means geopolitically is staggering. Wars have been fought over oil. No one’s going to invade for sunshine.

And that’s the quiet promise of this revolution. Decentralized power doesn’t just decarbonize economies—it redistributes agency. It empowers individuals, communities, and nations to unshackle themselves from legacy dependencies.

Conclusion: The Sun Conquers

Paradigm shifts of this magnitude—the Industrial Revolution, the rise of computing—rarely announce themselves with fireworks. But when they arrive, they redefine everything.

The insights drawn from McKibben’s forthcoming book deliver that quiet shock. What emerges is not speculation, but evidence. A meticulously documented, unapologetically optimistic vision of a world poised on the edge of salvation—not by hope alone, but by hard math, falling prices, and widespread will.

The sun, it seems, is not merely rising. It is conquering.