From the Wall Street Journal (April 17, 2020):

As the coronavirus pandemic upends work, travel and home life, the rules are shifting for what people can and can’t do in their daily lives. The WSJ is continuously updating advice and information on how to stay safe, healthy and connected, and how to help others.

Aid to a Friend Caring for a Coronavirus Patient

“Because I am organized in my job and day-to-day life, I took on my husband’s care thinking I would have it all quickly in hand. But things didn’t turn out that way,” writes Leslie Yazel, whose husband came down with coronavirus-related pneumonia. Here, she offers what she learned about the best ways to help those who are caring for someone with coronavirus.

Get a Good Night’s Sleep

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

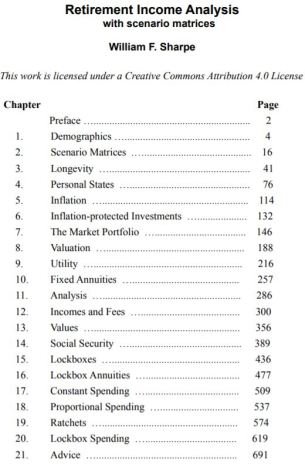

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision. Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.