From an Economist.com online article:

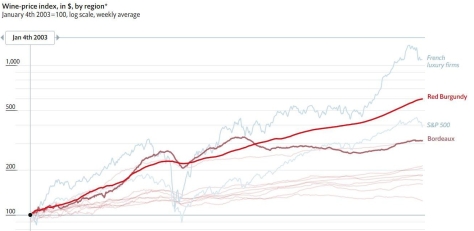

Collectors who have drunk most of their Pinot already may need another glass after seeing the results. By the end of 2018, red Burgundy had returned 497%, versus 279% for the s&p 500. (Our index does not extend to 2019, since many of the wines it contains have not been traded this year.)

The index has also been less volatile than stocks are, though this may be an artefact of how it is calculated: no one knows what each wine would have sold for in the crash of 2008-09. Bordeaux and Champagne rose by 214% in 2003-18; everywhere else did worse.

Wine collectors like to proclaim that “all roads lead to Burgundy.” They often wince at the plonk they drank when starting their hobby. In America and Australia, a common entry point is local “fruit bombs”: heavy, alcoholic wines that taste of plum or blackberry; bear the vanilla or mocha imprint of oak barrels; and should be drunk within a few years of bottling.

To read more click on the following link: https://www.economist.com/graphic-detail/2019/08/24/burgundy-wine-investors-have-beaten-the-stockmarket?cid1=cust/dailypicks1/n/bl/n/20190828n/owned/n/n/dailypicks1/n/n/NA/299647/n