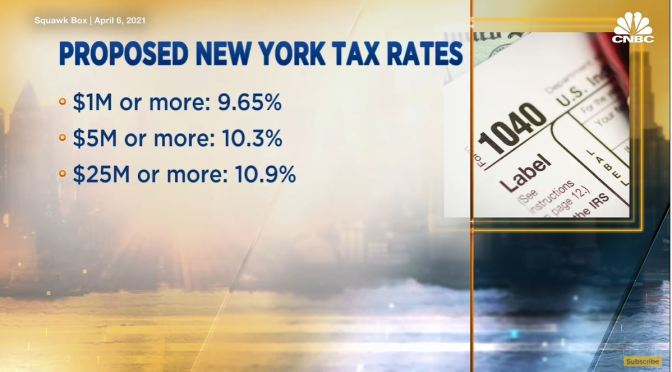

To balance their budgets during the coronavirus pandemic, states including New Jersey and New York have raised taxes on the wealthy. Conservatives warn that it will cause many of those who left at the onset of the pandemic make those moves permanent since they’re no longer bound to the physical locations of their offices or their children’s schools. But available data from 2020 show that the so-called exodus wasn’t as pronounced as initially projected, and the urban exit that did happen, was to suburbs rather than low tax states.

Tag Archives: Income Taxes

Finance: ‘What To Know About 2020 Tax Returns’

The coronavirus pandemic disrupted the global economy in ways that may affect your 2020 taxes. WSJ tax reporter Richard Rubin shares his tips for this unusual tax season. Photo illustration:Laura Kammermann

Boomers Retirement Abroad: You Can Escape State Tax In Seven States, But Never The IRS

From a Forbes.com article by Larry Light. Interview with Rick Kahler, founder of Kahler Financial Group, in Rapid City, S.D.:

“You have nothing to worry about if you live in one of the seven states with no income tax: South Dakota, Wyoming, Nevada, Washington, Texas, Florida and Alaska.”

The best way to escape paying taxes to a state you no longer live in? Move to a state with no income tax first before relocating abroad. You must prove to your old state that you have left and have no intention of ever coming back.

This means moving for real—cutting as many ties to your old state as possible and establishing as many as possible in your new state. You will want to sell your home, close bank accounts, cancel any mailing addresses, change healthcare providers and health insurance companies (including Medicare), be sure no dependents remain in the state, and register to vote and get a driver’s license in the new state.

Read more by clicking link below: