If you can save enough money now, you can fund your retirement by living off of your returns without draining your nest egg. Luckily, with time and dedication, you can make it happen. The official retirement age for most Americans is 67 years old. But that number largely matters for Social Security benefits. If you want to retire early, however, you will need a plan that relies primarily on your own savings and investments. CNBC crunched the numbers, and we can tell you how much you need to save now to safely get $75,000 of passive income every year in retirement. First, some ground rules. The numbers assume you will retire at 45, have no money in savings now and plan to save a substantial amount of income to reach your goal. For investing, we assume an annual 4% return when you are saving. We do not factor in inflation, taxes or any additional income you may get from Social Security and your 401(k). In retirement, we use the “4% rule,” which is a general principle that says you can comfortably withdraw 4% of your portfolio every year. It is important to note with the recent market volatility, there is a risk you’ll have to lower your spending percentage in the future. Check out this video to get a full breakdown of the numbers.

Tag Archives: Retirement Costs

Boomers Retirement: Three Of The Top Hidden Costs Facing Retirees

From a Wall Street Journal online article:

“many people are poorly prepared for unexpected expenses” in later life, the study notes. Even worse, about one in five retirees (19%) and one in four retired widows (24%) experienced four or more shocks during retirement. The good news: Many older adults who get hit with stealth expenses appear to bounce back.

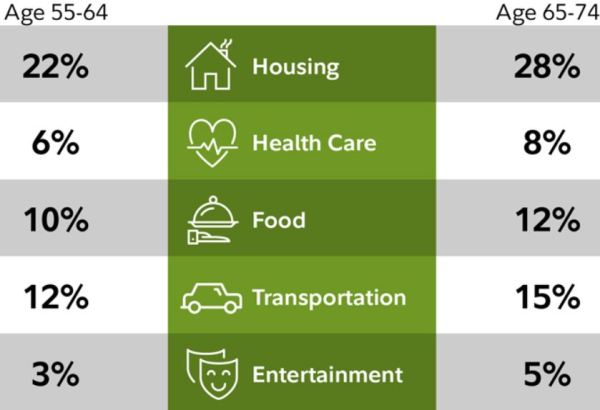

• Replacement costs. Big-ticket buys—a new furnace, updated appliances, a fresh coat of house paint—can put sizable dents in your nest egg. But most people don’t consider that these outlays can follow them into later life or that such costs can continue to add up for decades. A contributing factor: Many retirees underestimate their life expectancy.

• Relatives in need. This can hit you from two sides: aging parents feeling a financial pinch and younger family members who suddenly find themselves in a bind. With the latter, perhaps it can be an adult child who gets laid off or divorced, or a grandchild who needs help with tuition.

• Required distributions. Most people know that, after reaching age 70½, they must begin withdrawing funds from tax-deferred accounts (like IRAs). What they fail to understand are the ripple effects from these payouts. Required minimum distributions can, first, push you into a higher tax bracket and, second, translate into increased Medicare Part B premiums (which are tied to annual income).

• Required distributions. Most people know that, after reaching age 70½, they must begin withdrawing funds from tax-deferred accounts (like IRAs). What they fail to understand are the ripple effects from these payouts. Required minimum distributions can, first, push you into a higher tax bracket and, second, translate into increased Medicare Part B premiums (which are tied to annual income).

To read more: https://www.wsj.com/articles/the-expenses-people-often-forget-when-they-plan-for-retirement-11571321423