2020 is officially the busiest hurricane season on record and flooding is one of a storm’s most devastating consequences. FEMA estimates one inch of flood water can cause up to $25,000 in damage. The U.S. began offering nationalize flood insurance in 1968 but the program, called the NFIP, is now over $20 billion in debt. Private companies are starting to offer flood insurance as well. However, flood insurance is more complicated than it may appear. Watch the video to better understand how flood insurance works, and doesn’t work, in the U.S.

Tag Archives: Homeowners

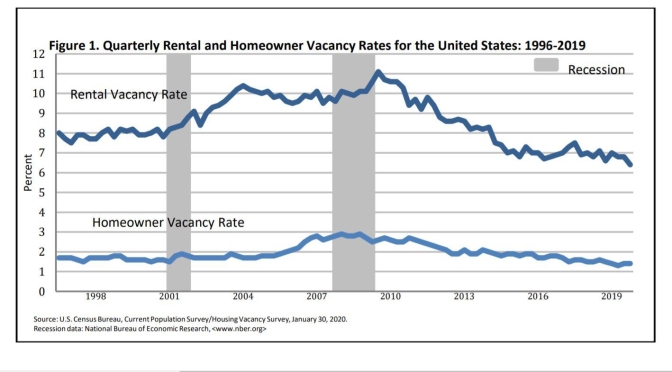

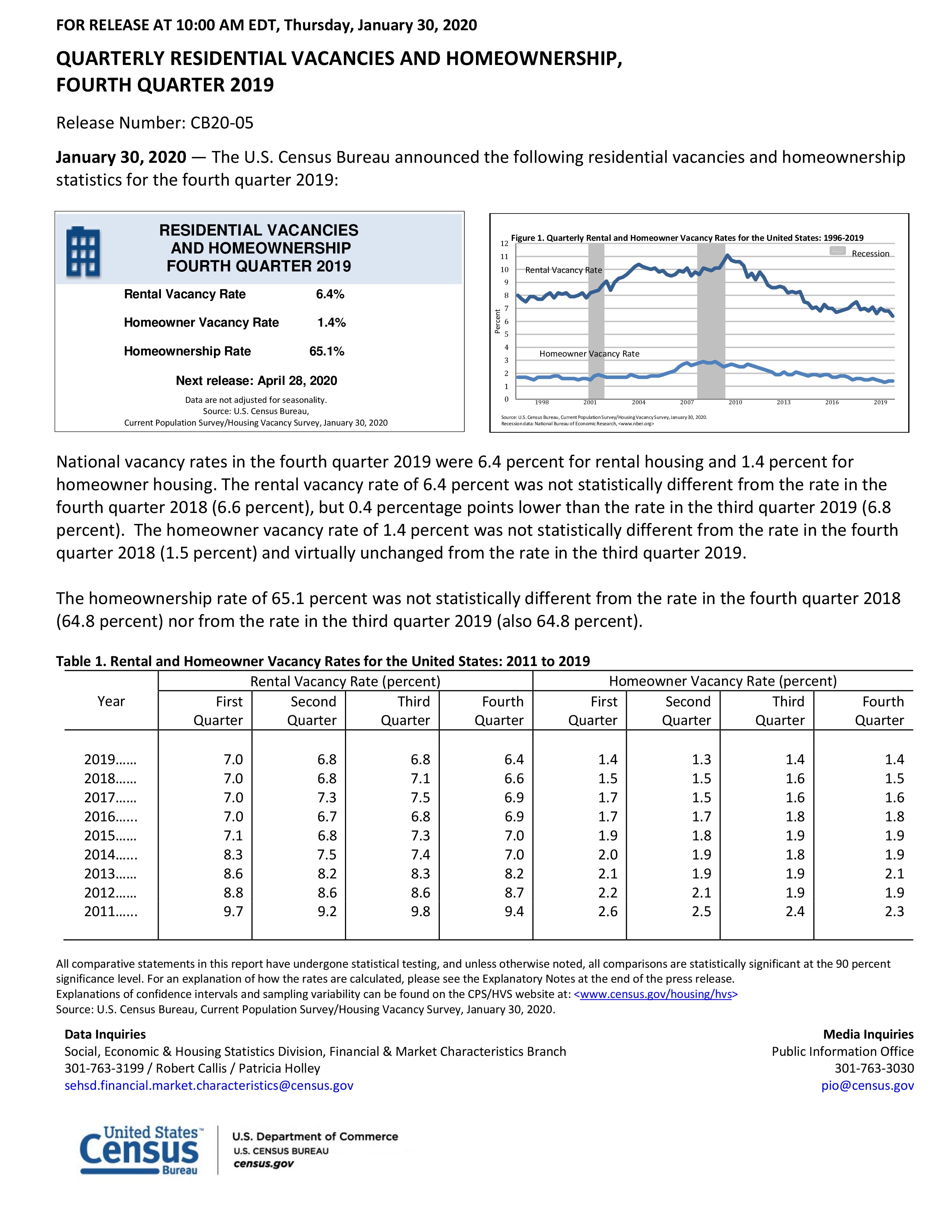

Housing: “Rental And Homeowner Vacancy Rates” (End Of 2019)

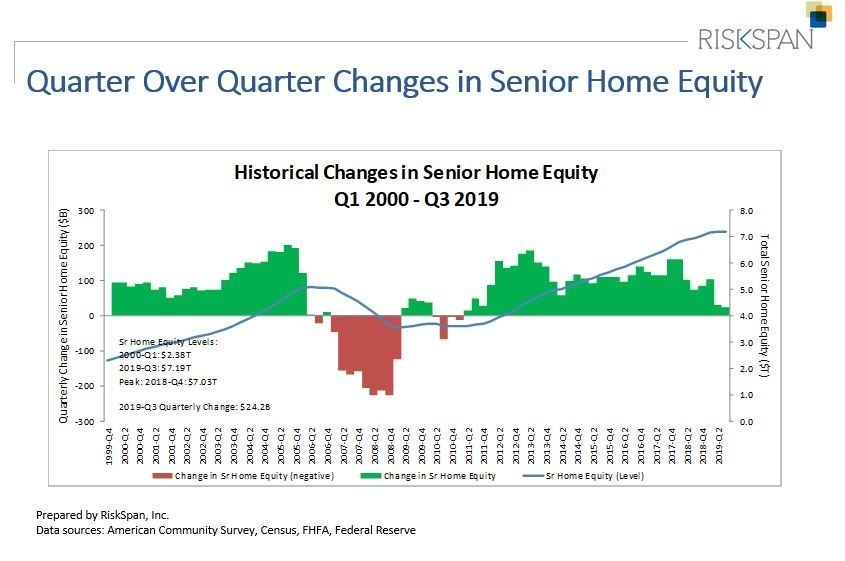

Housing Market: Seniors’ Home Equity Rises $24 Billion In 3rd Quarter 2019 To All-Time High

From a NRMLA online news release:

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”

“Research suggests that as we age, Americans will spend more of our hard-earned retirement assets on health care, such as insurance, prescription drugs, in-home care and other services that help us remain independent,” says NRMLA’s President Steve Irwin. “A retirement plan that includes the responsible use of home equity may be the best option that can help ensure healthcare spending doesn’t become a financial burden for many retired couples.”

(December 17, 2019) – Homeowners 62 and older saw their housing wealth grow by 0.3 percent or $24 billion in the third quarter to a record $7.19 trillion from Q2 2019, the National Reverse Mortgage Lenders Association reported today in its quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

The RMMI rose in Q3 2019 to 259.19, another all-time high since the index was first published in 2000. The increase in senior homeowners’ wealth was mainly driven by an estimated 0.5 percent or $40.7 billion increase in senior home values, offset by a one percent or $16.5 billion increase of senior-held mortgage debt.

To read more: https://www.nrmlaonline.org/about/press-releases/senior-housing-wealth-reaches-record-7-19-trillion