Feom a Barron’s online interview article:

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

Right now, you tend to have investment advisors for retirees, and insurance advisors or salespersons for retirees, and it’s fairly rare to go to somebody who can sell you annuities or invest your money and has no financial incentive to tilt one way or the other. Ultimately, what I’d like to see are people who have knowledge of both annuities and investments, and who are compensated in a way that doesn’t influence the decision.

The idea is that you segment your money. It’s similar to using “buckets” but with a time component. A retiree might have a box for 2020 and a box for 2021, and 2022, etc.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

Nobel Prize–winning economist William Sharpe has spent most of his career thinking about risk. He’s behind the Capital Asset Pricing Model for gauging systemic risk and the eponymous Sharpe ratio, which captures risk-adjusted return.

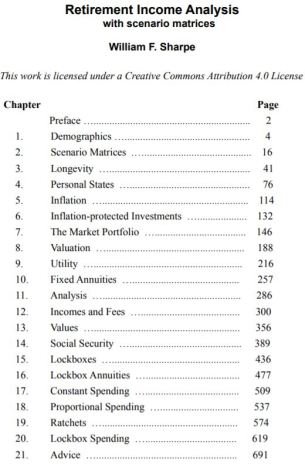

A few decades ago, Sharpe turned his attention to what may be the biggest risk of all for most Americans—running out of money in retirement. The professor of finance, emeritus, at Stanford University’s Graduate School of Business created a computer program that eventually covered 100,000 retirement-income scenarios based on different combinations of life spans and investment returns for a retired couple. Sharpe has made this program available in a free ebook, Retirement Income Scenario Matrices.

To read more: https://www.barrons.com/articles/william-sharpe-how-to-secure-lasting-retirement-income-51573837934

• Required distributions. Most people know that, after reaching age 70½, they must begin withdrawing funds from tax-deferred accounts (like IRAs). What they fail to understand are the ripple effects from these payouts. Required minimum distributions can, first, push you into a higher tax bracket and, second, translate into increased Medicare Part B premiums (which are tied to annual income).

• Required distributions. Most people know that, after reaching age 70½, they must begin withdrawing funds from tax-deferred accounts (like IRAs). What they fail to understand are the ripple effects from these payouts. Required minimum distributions can, first, push you into a higher tax bracket and, second, translate into increased Medicare Part B premiums (which are tied to annual income).

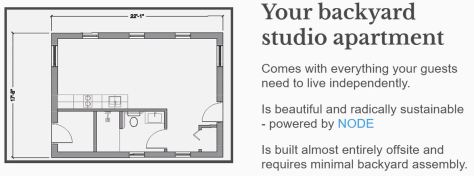

That’s why Kamber created

That’s why Kamber created

Rent the Backyard

Rent the Backyard

“Umbrella is an app that’s meant to connect these people with each other, through a marketplace with a membership model. The app lets seniors sign up for “jobs” and provide their services, like mowing a lawn or painting a fence.

“Umbrella is an app that’s meant to connect these people with each other, through a marketplace with a membership model. The app lets seniors sign up for “jobs” and provide their services, like mowing a lawn or painting a fence.