The Wall Street Journal (November 10, 2023) – There was plenty to learn from and entertain—including the third novel of a Richard Russo trilogy and a podcast with Julia Louis-Dreyfus

The Wall Street Journal (November 10, 2023) – There was plenty to learn from and entertain—including the third novel of a Richard Russo trilogy and a podcast with Julia Louis-Dreyfus

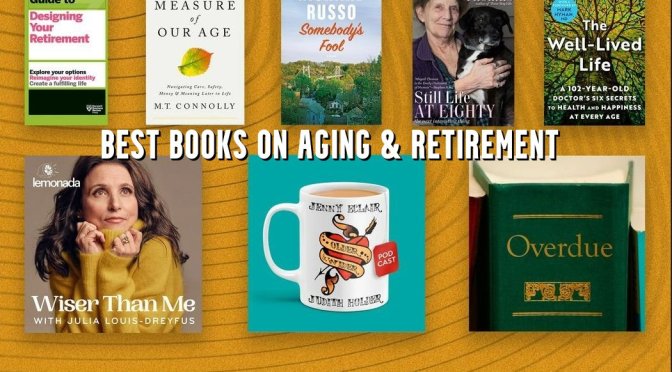

HBR Guide to Designing Your Retirement

By Harvard Business Review | Harvard Business Review Press (256 pages)

What sets this retirement guide apart from others is the perspectives brought by the contributing writers. In addition to presenting case histories and addressing the best ways to assess your life goals and financial needs, the authors discuss specific steps to help you think about encore careers in coaching, consulting or teaching; practical tips for coping with different stresses; and how to view the career you’re leaving as a period of “preretirement” to help you evaluate what comes next.

Still Life at Eighty: The Next Interesting Thing

By Abigail Thomas | Golden Notebook Press (196 pages)

Veteran book editor, agent and author Abigail Thomas begins her third memoir with the observation that at 80, her thoughts can sometimes be “interrupted by a memory so vivid that I am in two places at once.” Perhaps a jarring thought to some, but to Thomas, such moments can be “an inexpensive, unpatented, readily available form of time travel,” and readers who choose to accompany her will be rewarded.

Funny gripes, wistful reflections, rueful memories and realizations about aging fill these pages. Some of the best entries are about her days as a single mother of three living in Greenwich Village and protesting the Vietnam War. “The times that were a-changing have changed,” Thomas writes, “but for a little while I’m going to ignore what went off the rails, and let myself remember what innocence and hope felt like.”

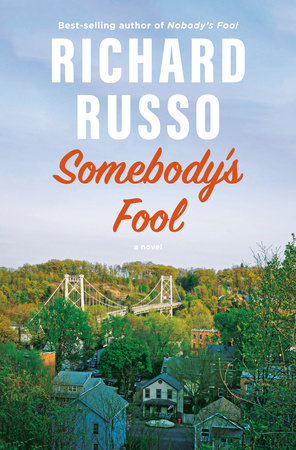

Somebody’s Fool

By Richard Russo | Knopf (464 pages)

The closing piece of the “North Bath” trilogy by Pulitzer Prize-winner Richard Russo is a wondrous novel that captures the changing pace of small-town life in the 21st century. The setting once again is a fictional, blue-collar community in upstate New York whose senior residents must grapple not only with the daily indignities of financial troubles and aging bodies, but with intrusions from the inhabitants of a more-prosperous neighboring town.

No worries if you are new to these books. You can jump right in to enjoy the fun even if you haven’t read the previous two (“Nobody’s Fool” and “Everyone’s Fool”). You can also expand your immersion in Russo’s world by streaming the 1994 movie of “Nobody’s Fool,” starring Paul Newman in an Oscar-nominated role.

The Measure of Our Age

By M.T. Connolly | PublicAffairs (384 pages)

In this compassionate book, M.T. Connolly, founding head of the Justice Department’s Elder Justice Initiative, lays out many of the problems associated with giving and finding care for seniors in our aging society. And as its subtitle, “Navigating Care, Safety, Money, and Meaning Later in Life,” suggests, she also has ideas for solutions to help avert a worse crisis.

Connolly draws on research, interviews and her own experience to explore these issues. “Our norms and systems have not kept up with our longevity, sometimes with terrible, and usually preventable, consequences,” she writes. She is optimistic, however, that “change is possible—and some is even under way” on community, federal and individual levels.

One thing that needs to continue, she writes, is “increasing our capacity to make meaning of aging, and of our fleeting time on Earth, by paying more attention to the power of purpose, curiosity, stories, awe, and love.”

The Well-Lived Life

By Dr. Gladys McGarey | Atria Books (256 pages)

To remain healthy in mind and body, consider the wisdom of Dr. Gladys McGarey, still a consulting physician at the age of 102, and co-founder of the American Holistic Medical Association. McGarey sums up her approach to life in six lessons, hence the book’s subtitle: “A 102-Year-Old Doctor’s Six Secrets to Health and Happiness at Every Age.” We won’t list them, and they are probably not what you would expect.

Based on her own experience—some of it difficult and emotionally draining—she places huge importance on the ability to regain perspective and purpose after a physical illness or crisis. This is essential for healing, medically and emotionally, says McGarey, whose own life story reveals she has had to practice what she preaches. At 69, she had to find a new path when her husband and medical partner of 46 years left her for a younger woman.